Geopolitical concerns cloud short-term global oil forecasts

Slowdown in Chinese economic growth and Iran nuclear deal shroud energy markets in uncertainty

By Kelli Ainsworth, Editorial Coordinator

Geopolitical developments, including China’s economic slowdown, the Iran nuclear deal and the potential lifting of the US ban on crude exports, will likely continue to be factors that prevent the oil price from recovering significantly in 2016. The effect these developments will have on the global oil supply and demand balance is unclear, which only adds more uncertainty to an already unpredictable market. “The level of volatility has increased substantially,” said Sam Ori, Executive Director of the Energy Policy Institute at the University of Chicago (EPIC). “That’s being driven by real uncertainty in the fundamentals of the oil market.”

Global oil supply exceeded demand by a massive 2.4 million BPD during the second quarter of 2015, according to the International Energy Agency (IEA). As long as the market remains oversupplied, it’s unlikely that events on the supply side will trigger any hikes in the oil price. “At a minimum, when I look at the how the fundamentals shake out for next year, I don’t see a price increase,” Mr Ori said. “It looks like we’re going to have this global supply overhang through 2016.”

- Inventories are up 2.4 million BPD from last year, according to the International Energy Agency (IEA).

- The IEA expects global oil demand to increase by 1.4 million BPD in 2016. The US Energy Information Administration forecasts that China’s oil demand will increase by 2.6% in 2016, down from 4% a year ago.

- The International Monetary Fund predicts China’s GDP will grow by just 6.3% in 2016, compared with 7.4% in 2014. Recent studies have indicated that lifting the US oil export ban could result in an average of 124,000 new jobs in the supply chain.

- The EIA projects 2015 will end up with an average WTI price of $50 and average Brent price of $54.

Further, he continued, Iran could begin putting an additional 500,000 BPD on the market as early as the first half of 2016. OPEC, which has so far refused to cut its production quotas, is unlikely to change this policy to accommodate Iran.

One note of optimism came from a Deloitte report released in August, which concluded that – although the additional oil from Iran will slow the recovery of prices – it should not lead to another price collapse.

But additional supplies may come from other sources, as well. Production from Libya that has been disrupted since the Arab Spring in 2010 may soon come back online, Matthew Jurecky, Head of Oil and Gas Research for GlobalData, said. At present, Libya produces approximately 200,000 BPD. “There’s talks of a peace deal between the two factions within Libya,” he said. “If that actually happens, you’re talking about another million BPD on the market in short order.”

Uncertainty is also rampant on the demand side of the equation. The IEA expects oil demand to increase by 1.4 million BPD in 2016, but the economic slowdown in China is throwing a wrench into analysts’ projections. “Global demand is really kind of unpredictable right now,” Mr Ori said. “That comes back to what’s happening with the Chinese economy and emerging markets in general. It’s a very uncertain picture prone to a lot of guessing and speculation.”

This uncertainty is negatively impacting the market, Mr Jurecky points out. “If you look to recent history,” he said, “when prices rose above $130/bbl, it wasn’t an imbalance between supply and demand that drove the increase. A large oil sands expansion had already begun in Canada, so had the boom in the Bakken, and the massive pre-salt had been discovered in Brazil. It was market psychology and traders pushing it up, in part playing off geopolitical fears or exaggerations of demand growth from China.” Without similar optimism about the market that drove prices upward a few years ago, he added, it’s hard to predict where prices might go.

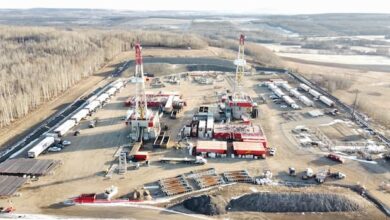

Even when prices do begin to recover, tight oil production might limit the extent of that recovery. This is because US tight oil activities can be ramped up quickly to add supply as soon as prices are high enough again, Mr Ori explained. Therefore, any recovery is likely to be moderate, and $100 oil is probably not in the cards. “I think tight oil made a return to that kind of dynamic impossible. Before prices ever get up that high, tight oil production growth will come roaring back and bring additional supplies to the market and really regulate that kind of increase in price,” he said. “So in some ways, tight oil has really put a ceiling on how high prices can go.” US Energy Information Administration (EIA) data shows that tight oil production began increasing substantially in 2009. Between 2009 and 2012, production increased from approximately 500,000 BPD to 1.5 million BPD. Production surpassed 3 million BPD in 2014.

Decrease in supply unlikely

OPEC focused on market share

In November 2014, OPEC announced that it would not cut its production quota to relieve pressure on the global oil supply. “Before that meeting, a significant chunk of the market still believed that OPEC would cut production to balance the market,” Mr Ori said. Back in the 1980s downturn, OPEC did cut its production in an ultimately futile effort to stabilize prices. This time, “they didn’t want to repeat the mistakes of the mid-’80s. The Saudis in particular saw that the size of the cut needed was not really feasible, and the price response would be too small to compensate for lost market share. In the end, they realized all they would be doing was temporarily propping up prices for their competitors while continuously losing market share.”

OPEC does not appear to be changing its mind on this anytime in the foreseeable future, said Jim Krane, Wallace S. Wilson Fellow in Energy Studies at Rice University’s Baker Institute for Public Policy. In particular, Saudi Arabia, OPEC’s largest producer, appears to be counting on supply and demand eventually coming back into balance and is determined to maintain its market share, he said.

Moreover, the Saudis and their fellow OPEC members hope that keeping their production stable will force competitors to take their production offline. “The Saudis are continually reinforcing their message, continually telling their OPEC brethren that it’s time to defend market share and it’s not time to be a price hawk,” Mr Krane said. “At least half of the OPEC countries are unhappy with this policy, but they don’t have the leverage to do anything about it,” he said, noting that Saudi Arabia remains OPEC’s most influential member.

Iran’s reentry into the global oil market

On 14 July, the P5+1 countries – the United States, Russia, France, the United Kingdom, China and Germany – and the European Union reached a landmark agreement with Iran. The deal places limits on Iran’s nuclear program such that the country could develop nuclear energy but not nuclear weapons. In exchange, economic sanctions against the country, which have been in place in varying degrees and force since 1979, would be lifted. This would allow Iran to export oil to the global market once more.

Once sanctions are lifted, which could happen by early 2016, “everybody’s going to be watching how quickly and to what extent barrels from Iran come back onto the world market,” said Andrew Slaughter, Executive Director of the Deloitte Center for Energy Solutions. Iran’s oil minister has stated lofty goals to increase production by 1 million BPD within six months of the sanctions being lifted, but Mr Slaughter called that number unrealistic. He estimates that Iran, which currently exports 1 million BPD, primarily to Asia, will be able to increase exports by between 300,000 and 500,000 BPD in the first year, with the ramp-up occurring gradually. “It’s going to take several years for them to get to those very high levels.”

Still, Iran is estimated to have 30-40 million bbl of oil in storage, and that oil can be put on the market as soon as sanctions are lifted, with no ramp-up required. Thereafter, to increase production, Iran will begin looking to international partners. However, Mr Slaughter said he believes it will be at least two to three more years before international oil companies will begin investing in Iran.

“They’ve talked about attracting investment from overseas oil companies, but it’s going to take a while for them to get comfortable that the post-sanctions regime is durable,” he explained. Companies will also likely hold back until they see what sort of fiscal terms Iran can offer and what local content requirements might be imposed.

The effect of Iranian oil on the global oil price is difficult to predict, experts say. Factors they must consider include exactly how much oil Iran will be able to bring to the market in 2016 and how much oil demand grows. However, even factoring in uncertainty around Chinese demand, Mr Slaughter said he doesn’t believe Iranian oil will drive oil prices down further. It would, however, limit any potential price recovery. “What Iran does is to kind of cap that. It means the price is not going to fly up very far, but it also means that it really doesn’t have a lot farther to fall. What could put that at risk is if global economies are much weaker than people are thinking and we have to dial down global demand growth numbers.”

In terms of production, the addition of Iranian oil does mean that supply is not likely to fall in the foreseeable future. “You have some areas of the world where production has come off, but potential (Iranian production) kind of balances it,” Mr Jurecky of GlobalData said. For example, conflicts in Yemen and South Sudan have disrupted oil production in those countries, he said.

Yemen has faced some degree of political instability due to conflict between the government and tribesmen since the country’s civil war in 1994. While the country produced more than 400,000 BPD in 2001, this instability limited producers’ ability to address natural field declines, leading to decreased production. Further, in 2014, a coalition of Yemeni tribesmen seized some of the country’s main checkpoints and prevented oil companies from accessing their fields. In 2014, only 125,000 BPD were produced, and GlobalData projects a 2015 production of just 30,000 BPD.

South Sudan faces similar issues with rebel forces. Before conflict set in in 2013, South Sudan produced 240,000 BPD, which fell to 165,000 BPD by 2014. In May 2015, rebel forces announced they will continue to target oil fields in an effort to cut off the government’s revenues. Although peace negotiations have been ongoing, they have not been fruitful to date.

Doubts about demand

Looking at the demand side of the energy equation, China is the juggernaut that can send waves rippling through the global economy. The country became the world’s largest net importer of oil in early 2014. Also last year, it accounted for more than a third of the growth in global oil demand, although this year the EIA is projecting China will account for a slightly lower percentage – approximately 25%. Demand is expected to further slow in China next year – the EIA forecast of 2.6% is lower than the 4% growth from the year prior.

This is certainly tied to the overall Chinese economy, and there are several causes of concern. First, the economy has not been growing as it once did. It grew by 7.4% in 2014 as estimated by the World Bank, and for 2015 the Chinese government has announced a goal to reach 7% growth. That appears to be an overly ambitious goal, however. The International Monetary Fund, in its 2015 World Economic Outlook, projected that China’s GDP growth will reach only 6.8% this year before dropping to 6.3% in 2016.

Mr Jurecky at GlobalData pins this slowdown to the fact that China is predominately an export-based economy, and the country is simply not exporting as much as it did in the past. “The conditions that are impacting China’s economy, to a large extent, are not actually within China,” he said. “The slowdown is stemming from outside China because their exports have fallen,” primarily due to the strength of the Chinese currency.

The Chinese government is already taking action, however. In August, China allowed its tightly controlled currency to fall, something the country’s Central Bank has been reluctant to do in the past. According to British newspaper The Guardian, the yuan fell on three consecutive days that month, reaching its lowest rate since 1994. The currency devaluation is widely seen as a strategy to boost China’s exports, as a cheaper yuan will make Chinese goods less expensive.

Another cause for concern with the Chinese economy – and, therefore, demand growth – is its volatile stock market. In August, the Shanghai Stock Exchange suffered its largest single-day loss, closing down 8.49%. The fall was attributed at least in part to worried investors recognizing the slowing economic growth and beginning to sell off stocks. Since June, the Shanghai composite index has fallen by almost 40%.

Despite these warning signals coming out of China, analysts say they don’t indicate a forthcoming dire crash in global oil demand. “The growth in demand is still primarily going to be driven by China going forward,” Mr Jurecky said. “I think the market crash and the turmoil has been perhaps amplified a bit, and the underlying fundamentals of their economy do remain in a position of strength going forward.”

What China’s situation does indicate, however, is that it will be even more difficult to forecast oil demand and oil prices going forward. Especially if there’s a further slowdown in China, Mr Ori of EPIC said, other developing countries will start to account for a greater share of oil demand growth. “Absent that kind of really strong demand growth from China, the outlook for global oil demand becomes a little bit more cloudy and a little bit less aggressive.”

Potential end to US export ban

As of mid-October, a bill proposing an end to the 40-year-old US ban on crude exports was still making its way through Congress. The ban was put in place in 1975, following the OPEC oil embargo, and the aim was to keep US oil at home and reduce dependence on foreign oil. Proponents argue, however, that the ban has outlived its original purpose and become a relic, Mr Krane of the Baker Institute said. “That was a bit of protectionism left over from the 1970s,” he said.

On 9 October, the US House of Representatives voted to repeal the ban by a margin of 261-159. As of press time, however, the bill was still in limbo, with the White House threatening a veto.

IADC President and CEO Stephen Colville has expressed support for lifting the ban, citing job creation as one of the primary benefits. “Today’s vote to repeal the outdated ban on exporting crude oil is a win for the US economy, particularly due to the huge implications for the creation of new jobs,” he stated in a news release issued on 9 October. “From the perspective of the drilling contractor community, this is an enormous benefit to our members. According to recent studies, lifting the ban would result in an average of 124,000 new jobs in the supply chain, contributing to 394,000 jobs in the greater economy through 2030. Particularly during a time of market uncertainty in the oil and gas industry, these job numbers are big and meaningful. Combined with the expected addition of $26 billion to the GDP per year from the crude oil supply chain, these numbers clearly provided a deeply compelling case for the US House to vote to lift the ban, and we support their efforts.”

Politicians remain highly aware, however, that a large portion of the public likely still remembers the gasoline shortages and long lines at the pump from the 1970s, which led to the export ban in the first place. That could be a serious impediment to the bill’s passage, Mr Ori said. “There’s a perception, right or wrong, that it’s politically risky to sign a bill that allows crude exports. People worry that six months down the line there could be some event in oil markets that causes prices to go up, and voters will then blame whoever supported exports when gasoline prices start increasing,” he said.

Although US oil production has increased since the 1970s, which has reduced the country’s need to import crude, the fear still exists that lifting the export ban will threaten energy security. That will likely continue to influence politicians’ willingness to pass the bill. “I think the vast majority of Americans are still very sensitive to increases in gas prices and still have the 1970s mentality of this is our oil and we should keep it here,” Mr Ori said.

Mr Krane takes a different stance, however, and believes the economic upside of lifting the ban could outweigh political concerns. If the ban were lifted, US producers could trade their oil on the global marketplace, at Brent prices, which are often higher than WTI prices. For 2015, the EIA is projecting an average WTI price of $50 and average Brent price of $54. Sometimes Brent prices can even go $15-20 higher than WTI, Mr Ori said. This means US producers could increase their profits and production and create more jobs if they were able to trade on the open market.

Allowing US producers to have the option to trade at the higher Brent prices also could help them manage downturns like this one, Mr Krane said. “The single most effective way in the short term of helping the beleaguered oil producers in the US is to lift the ban so at least WTI and US crude could trade somewhere near parity with Brent.”

For the rest of the world, lifting the US ban also will not equal bad news. Mr Krane said he doesn’t expect to see US production soar and flood the global supply market. Although there may be something of a price upside for US producers if they can trade on the global market, they will still likely wait until prices improve to take advantage of access to new customers. “At the current price, I doubt there would be a big surge in exports or production,” he said.

Further, US oil on the global market would be unlikely to diminish the importance of the Middle East as a global supplier. Mr Krane explained: “We can’t really compete with them on a price basis. When prices are low, oil production in those countries is very profitable. They are the global low price suppliers.” DC