Oil & Gas Markets

Accelerated production set to pressure oil prices

A recent report from Morningstar, an investment research company, notes that the oil market could be oversupplied as soon as next year if OPEC+ delivers on its plan to raise crude production by 547,000 barrels per day (bpd), even as macroeconomic risks persist. However, although the supply increases will likely weigh on oil prices and hurt the industry’s stock prices, it could help to create long-term opportunities.

The report noted that, although the supply hike was set to begin in September, excess supply has yet to reflect in inventory data or crude futures, largely due to strategic stockpiling activity in China and summer seasonal trends. Brent pricing has mostly held steady during Q3 between the mid- to high-$60/bbl range.

Still, the increases are tied to efforts to take back share from US shale and political pressure to keep oil prices low, and these goals won’t change in the near term, the report said.

In terms of M&A, although consolidation efforts were lower this year compared with prior years, pockets of activity remained. The first half of 2025 saw global deal value drop by a third, with fewer US shale deals primarily driving lower global activity. Africa, Asia and the Middle East are also contributing to the slowdown.

Looking ahead, a return to recent peak deal levels is unlikely due to geopolitical conflicts and commodity price headwinds. Morningstar noted that it expects to see more deals from producers diversifying their hydrocarbon exposure. Other producers may seek to gain a stronger foothold in low-cost resources like the Permian.

However, with US oil rig count continuing its slide since Q2 and WTI prices unlikely to increase beyond the mid-$60s, Permian-dominant producers will be more likely to cut drilling. Larger operators in this basin can cut volumes without materially pressuring either their unit economics or capital efficiency, the report noted. Moreover, the Permian’s cost advantage of drilling new wells is much narrower than serving existing wells.

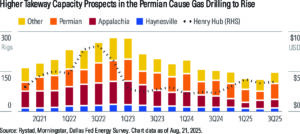

On the gas side, more long-term increases are expected, even if the near-term production outlook remains flat. The Marcellus and Utica regions have remained steady, while the Haynesville saw the loss of a single rig in August, down to 45. In the longer term, the need to meet natural gas demand for power use tied to AI/data centers, as well as LNG projects, supports steady long-term production increases.

The report also noted that Qatar is making large moves in the LNG space and aims to capture over 10% of global trade over the next decade by doubling its production capacity. Its projects in the giant North Field will help the country to achieve this goal.

Click here to access the Oil and Gas: 2025 Q3 report.

Capital budgets to fall in 2026 as long-term E&P investments take backseat

Oil and gas companies will plan for a tough year in 2026, with capital budgets set to decline as firms prioritize financial strength over long-term growth investments, according to Wood Mackenzie’s Corporate Strategic Planner Oil and Gas 2026.

Reinvestment rates will average 50%, enabling firms to return an average of 45% of operating cash flow to shareholders and, in some cases, de-leverage, even at Wood Mackenzie’s forecast annual average price of just under $60/bbl Brent for 2026.

“Oil and gas companies are caught between competing pressures as they plan for 2026. Near-term price downside risks clash with the need to extend hydrocarbon portfolios into the next decade. Meanwhile, shareholder return of capital and balance sheet discipline will constrain reinvestment rates,” said Tom Ellacott, Senior Vice President, Corporate Research at Wood Mackenzie. “Investors will continue to reward near-term priorities such as distributions, stable cash flow and balance sheet strength over long-horizon investments.”

The report also projects there will be further reductions in low-carbon spending as companies withdraw from low-return projects. Leading European majors will cap renewable and low-carbon investments at 30% of total budgets. Most large international oil companies and national oil companies will converge on allocating 10-20% of overall budgets to low-carbon initiatives. Capital allocation will swing back toward upstream investments, including exploration and business development.

Structural cost reductions will be a priority to boost margins and hedge against macro uncertainty. Efforts to simplify organizations, reduce headcount and deploy AI-enabled efficiency measures will intensify.

Key investment themes include prospect hopper reloading ahead of a renewed exploration drive, opportunistic M&A to extend oil and gas longevity, and vertical integration to unlock additional value while enabling fresh opportunities.