2025 NOV Rig Census shows global drilling industry shift toward efficiency, consolidation

Macroeconomic headwinds, shifting regional demand and a shrinking pool of modern rigs define a leaner, more disciplined industry

By Tarjei “TJ” Myklebust and Karl Appleton, NOV

The 2025 NOV Rig Census reflects a drilling industry adapting to shifting market conditions. Rising oil supply from OPEC+, softer demand growth and economic uncertainty slowed recent momentum, particularly offshore, while the onshore North American market continued its shift toward efficiency and high-specification capacity.

Capital discipline remained central as operators focused on technology upgrades and fleet high-grading over expansion, with mergers and acquisitions further consolidating the sector. Offshore fundamentals stayed solid, but jackup deployment shifted regionally, and floaters saw more idle time. With most stranded newbuilds absorbed and minimal new construction under way, the fleet is set to keep aging.

Looking ahead, drilling activity will be shaped by commodity prices, policy shifts, and the balance among energy security, core oil and gas profitability, and a broader energy mix — with growth driven more by efficiency than by fleet size.

Census highlights

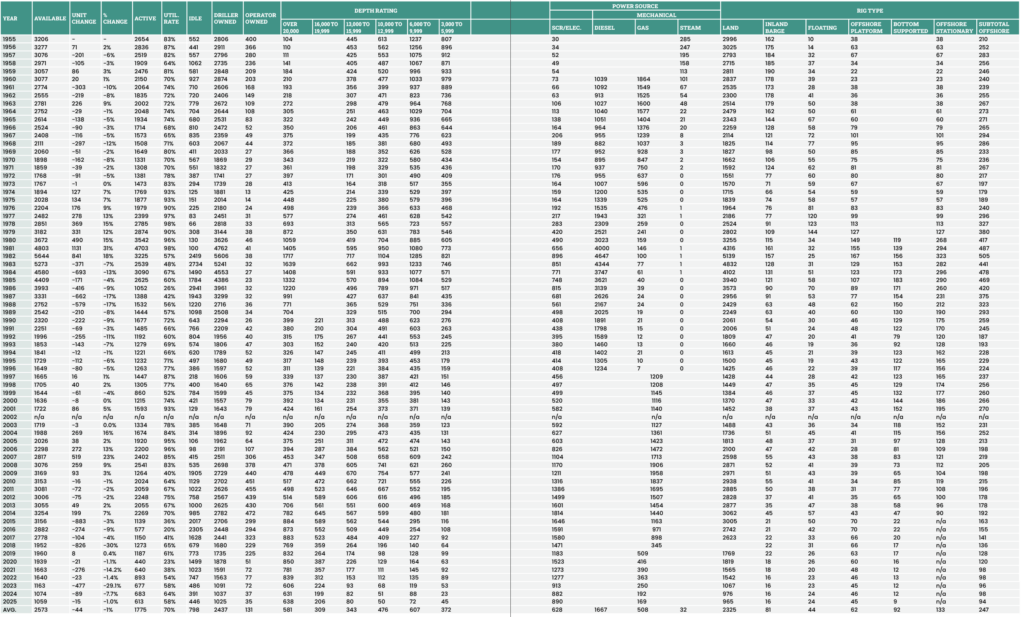

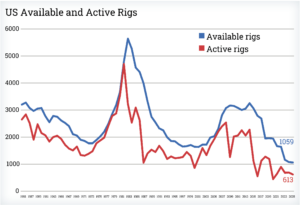

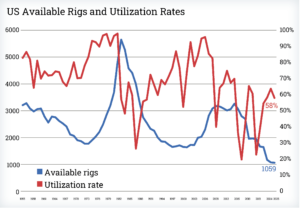

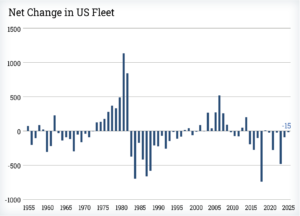

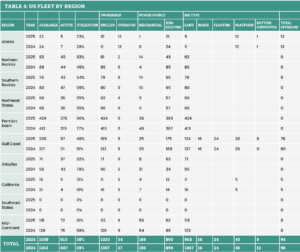

- The US available fleet, both land and offshore, decreased by 15 rigs to 1,059 — the smallest annual decline since 2019 — with offshore units down by four to 94.

- US active rigs totaled 613, down from 683 in 2024, resulting in a 58% utilization rate. Record oil production of 13.4 million barrels per day (bpd) was achieved with a leaner, more efficient fleet.

- US rig additions were limited to nine, the lowest annual total since 2021.

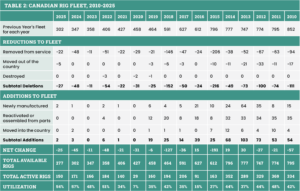

- The Canadian available fleet declined by 25 rigs to 277, while active rigs fell to 150. Utilization eased slightly to 54% but remained the second-highest since at least 2008.

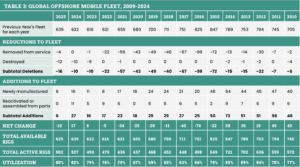

- The global mobile offshore drilling unit (MODU) fleet decreased by 10 units to 629 rigs. Active rigs fell to 502, with utilization at 80%, the second highest since 2015.

- Jackup utilization dipped following Saudi Aramco’s suspension of more than 40 rigs. Of those suspended units, 40% have been absorbed through redeployment, mostly to the Far East and Southeast Asia.

- In the floater market, the drillship and semisubmersible segments faced slower contracting, creating idle periods and softening dayrates; a gradual drillship recovery is anticipated from late 2026 into 2027.

- Global offshore fleet renewal: Since the 2024 census, only six rigs have been delivered — all long-stranded units. Stranded inventory is at its lowest in years, and minimal newbuild activity continues to contribute to an aging fleet profile.

- International land rig activity remained level in most areas except in Latin America, where it declined.

US fleet

The US available rig fleet totaled 1,059 in the 2025 census, down 15 rigs from last year. This marks the smallest annual decline since 2019, reflecting a slowdown in attrition after two years of steep reductions. The offshore fleet accounted for 94 rigs, four fewer than in 2024.

Despite the smaller fleet, US oil production reached a record 13.4 million barrels per day (bpd), underscoring continued efficiency gains from a more technologically advanced and high-graded fleet. These structural improvements allow operators to sustain high output levels while relying on fewer rigs.

US fleet rig additions

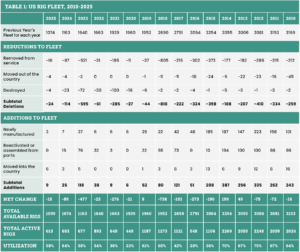

The fleet gained nine rigs, the lowest number of additions since 2020 and well below the recent five-year average of 40. Other than three newbuild land rigs, there were also six relocations – five of which were land rigs crossing the border from Canada and one drillship that moved from West Africa into the US Gulf. No cold-stacked rigs were reactivated.

For comparison, 387 rigs were added in 2014, including 187 newbuilds; that has been the peak for US additions in the past two decades.

US fleet rig attrition

A total of 24 rigs were removed from the US available fleet in the 2025 census, down significantly from 114 the previous year. These removals were partly offset by nine additions, resulting in a net reduction of 15 rigs in the total US fleet. As predicted in the 2024 census, the pace of attrition has slowed, with most rigs laid down during the COVID-19 downturn and inactive for more than three years already removed over the past two cycles.

Of the 24 rigs removed this year, just four were scrapped, all land rigs, compared with 23 scrapped rigs in 2024. No offshore rigs in the US were scrapped in this census. An additional 16 rigs were removed from the count per the census rule around prolonged inactivity. There were also four offshore rigs that relocated out of the US fleet — two drillships and two jackups — while one platform rig became inactive since the previous census period.

Canadian fleet

The total available Canadian rig fleet in the 2025 census declined to 277 rigs, down from 302 the previous year, a net decrease of 25. This reduction was driven by the removal of 27 rigs, including 22 units taken out of service due to prolonged inactivity and five rigs that moved to the US. The addition of two newbuilds partly offset these removals.

The available offshore fleet remained stable at four rigs, consisting of three platform rigs and one drill barge.

Global offshore mobile fleet

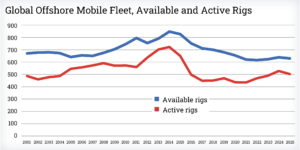

After two consecutive years of growth, the global MODU fleet declined slightly in the 2025 census. The available fleet totaled 629 rigs, down by 10 from 2024. This reversal was driven by a slowdown in new deliveries, continued market uncertainty and higher attrition, particularly among floaters.

A total of 16 rigs were removed from the fleet, of which 12 were scrapped and four were removed per census rules. Among the retirements were two drillships — one of which had never worked — and six semisubmersibles, including two harsh-environment units, with an average age of 28.7 years. Four jackups were also retired, averaging 43.3 years in age. No rigs were reactivated this year, a notable drop from 11 in the 2024 census.

Fleet additions were limited to six newbuilds — the lowest number since at least 2008 — all of which were long-stranded rigs finally delivered from shipyards.

Utilization remained high at 80%, although floater markets showed more idle periods between contracts. In the jackup segment, utilization dipped after Saudi Aramco suspended more than 30 rigs in 2024. However, many of those units have since been redeployed, particularly into the Far East and Southeast Asia.

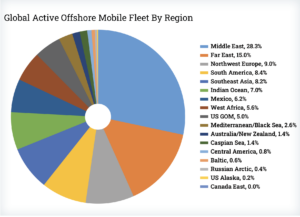

Regionally, the Middle East’s share of the global fleet declined from 31.6% to 28.3%. The Far East rose to 15.0%, while Northwest Europe edged down to 9.0%. Drillship activity remained concentrated in the Golden Triangle, which accounted for 86.5% of contracted units, led by South America (43.2%), the US Gulf (28.4%) and West Africa (14.9%). The North Sea continued to dominate semisubmersible activity, accounting for 37.5% of the active fleet, with Norway as the key driver.

US drilling activity and utilization

For a rig to be considered active in the 2025 census, it must have been drilling at least once during the period from 5 May through 21 June. A total of 613 rigs were active in the US during this year’s census window, down from 683 in 2024. Of these active units, 576 were onshore rigs, with a utilization rate of 60%, compared with 66% the year before. The offshore fleet had 37 active rigs, with a utilization rate of 39%, consistent with the previous census. However, if offshore platforms and inland barges were excluded from this equation, then the utilization rate for the remaining offshore rigs in the US would increase to 79%.

The Permian Basin remained the most active region, with 424 available rigs, of which 278 were active during the census period. While this still represents the highest number of active rigs among all US regions, the basin’s utilization rate declined from 77% in 2024 to 66% in 2025. This drop reflects continued capital discipline from large operators and a slowdown in private E&P activity, as the region shifts from aggressive growth to more measured development.

In the offshore segment, the drillship fleet continued to perform strongly, with 23 units present and a utilization rate of 91%. With one active semisubmersible, the segment yielded 100% utilization. The jackup fleet consisted of nine rigs, of which four were active, resulting in a 44% utilization rate.

By depth rating, rigs capable of drilling more than 20,000 ft comprised 60% of the available fleet and posted the highest utilization at 65%. In contrast, shallow-capacity rigs (3,000-5,999 ft) remained the least in demand, at 27% utilization.

Canadian drilling activity

Canada had 150 active drilling rigs during the 2025 census period, down from 171 in the previous census. This count includes three offshore rigs, all platform units, and 147 onshore rigs, down from 168 a year earlier. The overall utilization rate declined slightly to 54%, compared with 57% in 2024. Although this still represents the second-highest utilization rate since at least 2008, it is largely the result of a smaller available fleet rather than increased activity. In fact, the 150 active rigs mark the lowest number of active rigs since 2021, highlighting a modest slowdown in field operations.

Despite this decline, there are signs of cautious optimism. The completion of the Trans Mountain Expansion (TMX) and Coastal GasLink pipelines is expected to have a positive long-term effect on Canadian drilling activity, particularly in the heavy oil and natural gas segments. These infrastructure upgrades not only improve access to global markets via the West Coast but also help free up capacity in legacy pipelines, creating new opportunities for smaller Canadian producers. However, near-term growth remains muted due to tariff uncertainty and cautious capital budgets, especially among smaller operators.

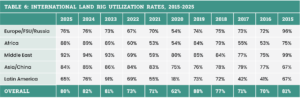

International land rig drilling activity and utilization

The count can be considered almost flat at 2,651, which includes estimates for the large Russian and Chinese fleets, and a utilization of 80%. Regional perspectives, omitting Russia and China, can be seen in Figures 7-10.

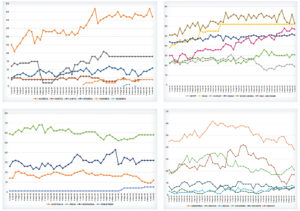

- Africa averaged 90 active rigs from May to June. Libya’s 38-year high in 2024 now stays level, but Algeria dominated. A star appearance by the offshore giant Namibia.

- The Middle East averaged 303 active rigs from May to June. The regional count rose on aggregate until January 2024, after which most countries flattened and Egypt dropped. Abu Dhabi showed constant growth.

- Asia Pacific (excluding China) averaged 116 active rigs from May to June. Since mid-2024, the regional count has slightly declined. India’s large fleet has held steady, while Australia reduced gas drilling and activity in the Philippines rose.

- Latin America averaged 103 active rigs from May to June. The large Argentine and Mexican fleets declined, lowering the regional count, while smaller fleets in Brazil and Bolivia increased.

- As in the previous year, Europe (excluding Russia) remained at 97 rigs during the census period, with Turkey and Ukraine flat overall. Changes occurred in smaller fleets: Croatia, France, Germany and Italy each added one rig to their existing one or two, while the UK and Switzerland dropped back to zero.

Global offshore mobile activity

Active MODUs totaled 502 in the 2025 census, down 25 rigs from last year. Utilization remained strong at 80%, the second highest since 2014, but white space increased across floater segments.

Jackup demand was tested by the temporary suspension of rigs in the Middle East, but redeployment to Asia Pacific and the Far East, alongside multi-year national oil company (NOC) contracts, helped stabilize activity. Average jackup contract lengths rose to 829 days in the first half of 2025 — 34% higher than in 2024 — reflecting a stronger emphasis on securing long-term capacity.

Drillships and semisubmersibles experienced a slowdown in contracting, with more idle time between projects and downward pressure on dayrates. Broader macro headwinds, including softer oil demand growth and delayed final investment decisions (FID), added to this softness.

Offshore industry trends

After two years of steady growth, offshore rig markets entered a period of adjustment in 2025, with active units falling to 502. Although utilization stayed at 80%, the balance shifted as white space and regional redeployments became more common.

Drillship demand is expected to gradually recover from the second half of 2026 into 2027, led by long-term programs in the Golden Triangle, particularly Brazil, with additional growth in West Africa and Guyana. Semisubmersible demand is likely to remain muted, concentrated in Norway and selected harsh-environment campaigns elsewhere.

Jackup utilization eased after Saudi Aramco’s suspensions but stabilized as rigs were absorbed into the UAE, Southeast Asia and the Far East. Dayrates remain under pressure, but contract durations are lengthening.

On the supply side, the once-large inventory of stranded rigs has been mostly cleared. Only six drillships remain stranded in shipyards globally (down from 18 in 2021), along with 10 jackups and seven semisubmersibles. With newbuild activity limited to a few potential jackup orders by NOCs in the Middle East or Southeast Asia, the fleet is expected to remain broadly stable in size but will continue to age. In fact, 32% of jackups are already more than 30 years old (26% if excluding cold-stacked units), while drillships average 12 years but will approach 20 years by 2035 without new orders. Semis average 22 years with little sign of renewal.

Overall, the offshore market is trending toward a near-term balance between supply and demand. Jackup utilization remains relatively steady, while the drillship segment is expected to begin a gradual recovery in late 2026, led by long-term programs in the Golden Triangle. At the same time, limited newbuild activity and an aging fleet point to constrained renewal, with stranded rig supply now largely depleted. Ongoing consolidation has concentrated more than half of the global fleet in the hands of the top 10 contractors. This concentration, together with the finite pool of modern high-spec rigs, could set the stage for tighter market conditions once demand strengthens.

US industry trends

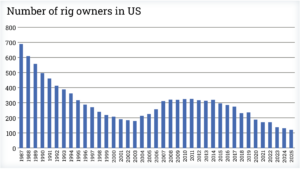

The number of individual rig owners in the US continued its long-term decline, falling to 121 in 2025 from 131 the year before. Of the 1,059 rigs in the US available fleet, 34 were operator-owned and 1,025 were contractor-owned, reflecting ongoing consolidation across the sector.

Mergers and acquisitions remained active among onshore drilling contractors, often focused on expanding market reach or upgrading fleet quality. This activity has led to continued high-grading, with older, less capable rigs exiting the market. The shift aligns with broader industry trends prioritizing rig efficiency and capability over fleet size.

Operators now require significantly fewer rigs to sustain record production levels than they did just a few years ago. This is due to the widespread adoption of pad drilling, automation and equipment upgrades, such as converting DC to AC rigs, increasing hookload and pump capacity, and integrating digital controls. While rig counts have declined, the performance of the fleet has improved materially, reducing the likelihood of a major rebound in rig numbers unless commodity prices, particularly for gas, increase substantially.

Meanwhile, dayrates in the US land market have continued to soften, with the average rate for a super-spec rig at approximately $28,500 per day. The Permian premium has eroded, and the highest dayrates were observed in the Rocky Mountains and Mid-Continent regions, driven by localized demand.

Overall, the US land drilling market remains defined by capital discipline, technical capability and selective investment, with a smaller but more advanced rig fleet meeting the needs of an increasingly efficiency-focused operator base.

US forecast for next year

The US drilling market in 2026 is expected to be shaped by ongoing oversupply, economic uncertainty and capital discipline. The accelerated unwinding of OPEC+’s voluntary cuts led to production increases in 2025, which shifted the oil market from undersupplied to oversupplied, leading to growing inventories. As a result, Brent crude is forecast to fall from $71/bbl in mid-2025 to around $50/bbl in early 2026, while WTI is expected to track between the high $40s and low $50s, which is below the breakeven levels for many operators. This environment is likely to apply downward pressure on US land rig activity through at least the first half of the year.

Additional headwinds stem from broader macroeconomic factors, including tariff policy uncertainty, weaker-than-expected demand growth in China, and inflation concerns, all of which contribute to more cautious drilling decisions.

Given these conditions, the US land rig count is projected to remain flat or decline slightly. However, improved efficiency, driven by longer laterals, automation and high-spec equipment, will continue to support strong output with fewer rigs.

Natural gas presents a potential upside. Henry Hub prices are forecast to reach $4.30/MMBtu in 2026, supported by flat supply and rising LNG exports. Demand growth from sectors like data centers and heavy industry could further strengthen the outlook for gas-directed drilling.

Selective consolidation of operators and contractors is expected to continue, particularly among regional players, alongside sustained investment in rig upgrades such as AC conversions and digital technologies to maintain competitiveness.

In summary, the US drilling market in 2026 is expected to be defined by:

- Lower oil prices

- Flat or slightly declining rig count

- Strong efficiency-driven production

- Potential upside in gas activity if price gains hold

Operators are likely to continue prioritizing capital discipline, operational efficiency and targeted technology investment. DC

IHS Markit is the primary source for the global offshore fleet, while Enverus provided the source material for the US and Canadian onshore fleets. Information for the international land fleet was found using both Baker Hughes data and Spears information collected and analyzed by NOV personnel. Oil and gas forecasts are provided by EIA STEO, August edition.