Horizontal drilling, multi-stage fracturing drive surge in onshore volumes, key to reversing decades-long production decline

By Katherine Scott, editorial coordinator

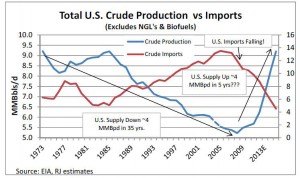

Horizontal drilling and multi-stage fracturing are working hard for the industry, and the results are paying off. According to research by Raymond James and Associates, by opening the door to vast resources of unconventional liquids, the industry has radically reshaped the trajectory of US oil production. This is reversing a nearly four-decade-long decline in oil production.

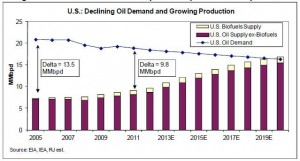

Coupled with declining US oil demand due in part to better vehicle efficiency, the shift is moving the country toward energy independence. Owed to fact that US oil and gas companies have already overcome government road blocks and geological challenges to increase oil supply, and a change in transportation habits has decreased oil demand, Raymond James expects that US net oil imports could reach essentially zero by 2020.

On 22 March at Ohio State University, US President Barack Obama made the claim that the US cannot become energy independent solely by doing more drilling, saying that “we can’t simply drill our way out of the problem.”

Marshall Adkins, managing director, head of energy research for Raymond James, strongly disagrees. “The facts say something very different. The facts say that we are drilling our way out of this. (We’re moving toward being) totally oil independent.”

The recent boost in US oil production, which reached 8.1 million bbl/day last year, and cuts in oil demand are causing imports to fall, which Mr Adkins said is a major part of attaining oil independence for the US.

“It appears that demand will continue to drift lower, but the real driver is more supply, so you combine roughly two barrels of supply growth for every one barrel of decline in demand, and you’re getting pretty meaningful reduction in the amount of oil we need to import,” he explained.

Increasing oil supply

Research by Raymond James suggests that the US produced more incremental oil supply than any other country from 2009 to 2011. The growth doesn’t stop there; it is projected that, compared with 2011, there will be a 6% increase in oil production this year and an average 11% growth per year between 2013 and 2015, most of it driven by the ongoing surge in onshore volumes. The use of horizontal drilling and multi-stage fracturing in areas like the Bakken, Eagle Ford and Permian Basin is allowing the industry to get more oil out of the ground.

Declining oil demand

Likewise, Raymond James projected that there will be a base decline in oil demand of 1.5% each year through 2020. US oil demand peaked in 2005 at 20.8 million bbl/day, having grown in every year but one since 1992. However, since then, demand has fallen in every year but one, and Raymond James estimates that there will be a decline of 2.5% for 2012 relative to a year ago.

Mr Adkins said that the decline in US oil demand has largely come from higher energy prices, which in turn are pushing better vehicle efficiency, more natural gas vehicles and reduced travel patterns.

Decreasing oil imports

In light of this increased supply and decreased demand scenario, Raymond James concluded that the US is poised to sharply decrease its dependence on other countries for imported oil. Their research shows net US oil imports already falling from 13.5 million bbl/day (65% of demand) in 2005 to approximately 9.8 million bbl/day (52% of demand) in 2011, and that may fall to an estimated 4.5 million bbl/day (26% of demand) by 2015.

Additionally, lower oil import costs could stimulate resurgence in US manufacturing, bringing with it more jobs.

“This is also a huge boom to US labor, across the board. It’s not just in the energy business, but you know cheap energy creates more manufacturing jobs,” Mr Adkins said, “The single biggest, most visible and immediate benefits to this … is more jobs.”

US trade deficit

Another important aspect to consider is the US trade deficit, where oil imports play a large role. According to the research, oil imports have generated more than half of the total deficit every year since 2007.

“(Decreasing oil imports is) hugely positive for the trade deficit. In the last several years, over half of our trade deficit has been energy related, and if you eliminate that, then your trade deficit gets cut in half,” Mr Adkins said.

Despite adding to the total deficit, the net oil import requirement has dropped every year since 2005, with further declines projected. With an approximately 2.2 million bbl/day reduction in imports since 2008, the US has reduced that part of the deficit by approximately $80 billion annually.

Mr Adkins believes that the resulting savings in the trade deficit are highly meaningful, especially when the benefits of cheaper energy for US manufacturing are taken into account. Further, their research states that the trends of lower oil import costs, cheaper US natural gas prices and decreasing non-oil related trade deficit point to a reduction in the total US trade deficit of 82% by 2020.

Despite these findings, however, Mr Adkins believes there are still additional steps that need to be taken. “(If we increase access to drilling), it will speed up the process of becoming energy independent.”