Modest signs indicate a comeback may be in the offing for Brazil

Industry remains in survival mode, but regulatory reforms and technical innovations are setting the stage for transition toward a brighter future

By Jessica Whiteside, Contributor

On paper, things look grim in Brazil’s offshore drilling market. Last year’s low rig activity has drifted into 2019, reflecting the slowdown that’s plagued the sector since oil prices tanked and a corruption crisis humbled national oil giant Petrobras. However, industry observers see modest signs the sector is heading for a comeback in the long term, thanks to the country’s ongoing efforts to expand exploration and production opportunities in the pre-salt and beyond.

But, first, there will be continuing pain for drilling contractors before the gap closes between the time operators begin assessing their newly acquired blocks and when they’re ready to start drilling.

“We’re just starting to see some new exploration taking place among the IOCs that took on some of those new blocks,” said Leslie Cook, Principal Analyst on the upstream supply chain team at Wood Mackenzie. She noted that Shell and Equinor both have drilling plans for Brazil this year, and Total is keen to bring in a rig pending permits for its Foz do Amazonas work.

“It really is a transition year,” she said.

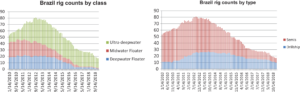

Rig Counts and Utilization

The level of offshore drilling in Brazil today is still a fragment of what it was before the downturn, and that largely mirrors the fortunes of Petrobras. Almost 50 rigs have been taken out of active supply in Brazil since 2014, Ms Cook said. Back then, she added, Petrobras alone had 65 rigs; this year, the company has about 14 in the offshore segment, and that could go down to 10 by June as four more rigs roll off contract in the first half of the year.

Rig utilization is also low compared with pre-downturn conditions. In 2014, it was hard to find a rig in Brazil that wasn’t working, with an active utilization rate of 99%. Fast forward to early 2019, and the active utilization rate is around 76%, Ms Cook said. That’s a little higher than the global rate of 68%, in part because rigs in stacked mode are more likely to be found in other parts of the world that have greater access to ports, shipyards and markets, she explained.

- Drilling activity is still a fragment of what it was, with active utilization at around 76%.

- New president is expected to build on regulatory changes introduced by predecessor.

- Petrobras is deploying AI, machine learning to improve its capabilities to predict behavior of pre-salt formations.

- Contractors still face tough year in 2019 despite optimism for better future.

By Wood Mackenzie’s count, there were 25 active floaters in Brazil by late January, of which 19 were either actively operating or securely contracted and six were either on standby or warm stacked. The count does not include the four rigs that Sete Brazil has put up for sale and that Petrobras has pledged to use for future projects. The amount collected from the sale of the charter and operation contracts of the units will be used to pay for the completion of the works in the two shipyards, Ms Cook said, adding it is unlikely any of the rigs will go into service before 2020.

About 75% of the active rigs this year are working on development wells. Of the rigs in active operation, 12 are drillships and seven are semisubmersibles, although five of those semis are scheduled to roll off contract this year. Ms Cook expressed skepticism that all of these rigs would find new work in Brazil’s deepwater because of an operator preference seen globally for drillships; however, they may pick up contracts in the country’s more mature basins for development, infill or intervention work, she said.

“By the end of 2019, we could actually see the rig count in Brazil go down before it comes back up,” she said.

As rig activity has dropped in Brazil, the country’s share of the Latin American fleet count has declined, too. Brazil now has 75% of the active floating rigs in Latin America, which is down from over 95% at its peak. That’s not necessarily a bad thing, Ms Cook said, because having more rigs in the vicinity as activity builds in neighboring Guyana and Suriname makes it easier to move a rig to Brazil if needed.

Dayrate Deals

There have only been a few new drilling contracts signed in Brazil over the past few years for sixth- and seventh-generation, high-spec, ultra-deepwater drillships, with dayrates ranging from $130,000 to $270,000, Ms Cook said. Her team considers the $130,000 contract to be an outlier and estimates the leading edge for such drillships from an international contractor would be closer to $230,000 to $250,000 for 2019 and 2020, although rates could potentially be lower from domestic contractors. Most semisubmersibles operating in Brazil are under legacy contracts. The dayrate for one recent renewal for intervention work was an estimated $140,000, Ms Cook said.

Generally, rates in Brazil are skewing a bit higher than in the Gulf of Mexico, where there is more competition and the leading edge is still below $200,000 for drillships, she added.

Another trend is the prevalence of contracts for less than a year, which appears to be favored by both operators and drilling contractors in the current market. For operators, shorter contracts enable them to negotiate lower rates, Ms Cook said. For contractors, it prevents them from getting into long-term deals when the leading edge for dayrates is so low.

Political Change

Jair Bolsonaro took office as Brazil’s 38th president on 1 January after a dramatic runoff victory in October. He moved swiftly to make several appointments affecting the oil and gas sector, including economist Roberto Castello Branco as the new CEO of Petrobras and Bento Albuquerque as Minister of Mines and Energy. Returning as the ministry’s Secretary of Petroleum, Natural Gas and Biofuels is a previous holder of the post, Márcio Félix.

In a speech to the World Economic Forum in Davos three weeks after taking office, Mr Bolsonaro pledged to position Brazil as one of the 50 best countries in the world in which to do business by fighting corruption, pursuing privatization initiatives, streamlining rules and opening the economy to foreign investment.

S&P Global Platts expects Mr Bolsonaro to build on the regulatory changes introduced by his predecessor, Michel Temer, such as relaxation of local content requirements and continuation of production-sharing auctions and bid rounds. The company also said it expects to see more exploration and development incentives for small companies and those operating in unconventional areas, citing plans by the National Agency of Petroleum, Natural Gas and Biofuels (ANP) to reduce royalties on incremental production for mature fields to improve their economics.

“The new administration is market-friendly and supports increased private and foreign participation in the oil and gas industry,” said Connor Wiik, Global Supply Analyst at S&P Global Platts. The government’s anticipated approach – combined with the four new 150,000-bbl/day FPSOs scheduled to produce first oil in Brazil this year and the success of the latest pre-salt auctions – point to strength in the upstream sector going forward, he added.

Regulatory Adjustments

ANP and the federal government have made a series of regulatory changes in the past two years to make investment in Brazil’s oil and gas sector more attractive, including the establishment of the multiyear schedule of bidding rounds, the end of the obligation of Petrobras to be the pre-salt operator, new local content policies and extension of contracts, among others.

Currently, ANP is reviewing the rules of the research, development and innovation clause in contracts for oil and gas exploration and production. This clause requires companies to invest 1% of the gross revenue of production from large fields in research and development. ANP told Drilling Contractor that 12 projects connected to well drilling use resources from the research and development clause, including four involving the development of prototypes or pilot units.

The agency is also working on regulating procedures for contract assignment processes, including the possibility of adopting reserve-based lending. It has also opened public consultation on possible changes in regulation for the delimitation of the area of oil or natural gas fields. Among the aspects to be evaluated are the pooling of reservoirs, the definition of continuous reservoir and facilities and equipment to be considered.

In addition, ANP has opened public consultation on the creation of regulatory instruments to encourage the development of oil and gas accumulations with low economic attractiveness. Recent measures implemented include a resolution on the reduction of the royalty rate for mature fields, a National Council for Energy Policy (CNPE) resolution for the return or assignment of rights to non-production fields, and a resolution by ANP’s Board of Directors to assign rights to fields with low investment levels.

One initiative expanding in 2019 is the Open Acreage program, which aims to encourage exploration or rehabilitation and production of oil and gas in areas with marginal accumulations, including blocks not sold in previous auctions. The program makes blocks available through a continuous offer, meaning companies do not have to wait for regular bidding rounds to participate. The second wave of the program, planned for the first half of 2019, will offer 1,039 blocks in seven onshore basins and 13 offshore basins. ANP said there are already 28 registered companies able to present a declaration of interest for available areas.

Transfer of Rights

The new government has also made it a priority to address the dispute with Petrobras over the transfer of rights, also called Cessão Onerosa. In 2010, the government acquired additional equity in Petrobras in exchange for granting the company the exclusive right to drill for 5 billion barrels of oil in the pre-salt Santos basin. The agreement became problematic when the area turned out to contain potentially billions more in commercially viable deposits. The government wants to raise funds by selling development rights for some of that extra oil to other operators – and Petrobras wants to be compensated.

Negotiations between the two parties resulted in a draft amendment to the original agreement, now being reviewed by Brazil’s Federal Court of Accounts (TCU). Petrobras stated on 8 January that the draft includes a scenario that could result in a $14 billion credit to Petrobras, if approved by the parties involved.

In a presentation to oil and gas sector representatives on 24 January, Mr Albuquerque listed auctioning of surplus oil from the Cessão Onerosa in 2019 as a priority for his ministry. Such an auction, which ANP said is expected to take place in the second half of the year, could raise an estimated $27 billion for the government from signature bonuses alone.

Bidding Rounds

Mr Albuquerque’s presentation to the industry also prioritized a multiyear calendar system to guarantee continuity for the country’s exploration bidding rounds. The current calendar provides for auctions through 2021. Two of those are expected in the second half of 2019. The Ministry of Mines and Energy has signaled 2 October for the concession round and 1 November for the production-sharing round, according to ANP; however, the CNPE has not yet confirmed those dates.

The 16th round of the concession regime will offer 42 blocks in the Pernambuco-Paraíba, Jacuíbe, Camamu-Almada, Campos and Santos sedimentary basins. The sixth production-sharing bidding round in the pre-salt will offer blocks in the Aram, Bumerangue, Cruzeiro do Sul, Sudoeste de Sagitário and Norte de Brava areas.

The fifth round last September raised approximately $1.7 billion in signing bonuses for blocks going to Petrobras and three coalitions with Shell, ExxonMobil and BP as operators. The sixth round could eclipse that total if all five areas sell, which would generate the equivalent of around $2 billion in signing bonuses.

Such bonuses are only a fraction of the impact Brazil’s oil and gas auctions could have on the country. With the already completed and scheduled bidding rounds, Brazil’s oil production has the potential to rise from an average 2.5 million bbl/day in 2018 to 7.5 million bbl/day by 2030, according to ANP. The number of platforms could increase from the current 107 to 180, while crude oil exports could quadruple to 4 million bbl/day.

The bidding rounds from 2017 and 2018 alone could result in $112 billion in new investment, $425 billion in tax revenues, about 20 new platforms and hundreds of wells, according to ANP. Those additional wells would be a dramatic boost to a sector that drilled only 28 exploration wells in 2018 (20 onshore and eight offshore) and 152 development and production wells (101 onshore and 51 offshore). Of exploratory wells spudded or concluded in 2018, ANP reports 12 notified discoveries – nine onshore and three offshore, all in pre-salt areas.

How will these auctions affect drillers? Before the downturn, 90% of rigs in Brazil were Petrobras-operated. Since then, the consolidation of Petrobras’ operations – and the government’s willingness to relicense its former blocks for other operators – has raised global interest in Brazil’s offshore, and that’s key for future growth, Ms Cook of Wood Mackenzie said.

“What Brazil has long needed is a mixture of players,” she said. “It’s always been very top heavy, with Petrobras doing the majority of the work and IOCs getting just bits and pieces here and there – nibbles – so this all bodes well for the longer-term proposition of Brazil.”

There are now 98 groups operating in Brazil from 24 countries, said ANP. Five new companies registered to participate in the 2018 bidding rounds, though none of the winners were new entrants.

Petrobras Prepares for Bids

Petrobras has already expressed interest in bidding on three blocks in the sixth round: Aram, Norte de Brava and Sudoeste de Sagitário. The company notified the CNPE on 14 January that it wants to exercise its preemption right to take on the role of operator for these blocks, with the potential to increase its minimum stake of 30% by forming a consortium.

Acquisition of these blocks would align with the company’s strategy to prioritize deepwater operations.

According to its business management plan, Petrobras intends to invest $68.8 billion in exploration and production from 2019 to 2023, including $48.4 billion for production development. Of that, 56% will be dedicated to the development of pre-salt resources.

In his inaugural speech as CEO on 3 January, Mr Castello Branco described oil exploration and production in ultra-deepwaters as the company’s “core competency” and stressed the need for technological changes to improve results.

“It is essential for Petrobras to digitally transform to reduce costs and boost productivity,” he said.

The company continues to face complex drilling challenges in the pre-salt, where behavior is difficult to predict and contingency planning is critical. Stuck pipe during drilling is a continuing issue, as is severe losses during circulation. Being able to predict the behavior of pre-salt formations will go a long way toward resolving these issues, and Petrobras says extensive studies have significantly improved its predictive capabilities.

Artificial intelligence (AI) and machine learning are already being used to improve the prediction of loss-of-circulation zones, which is supporting more robust well designs. And in 2019, initiatives to apply AI in preventing stuck pipe will reach the field implementation stage. This is expected to reduce associated nonproductive time. Machine learning also is being studied for developing drill bits programs and to identify shallow hazards.

Further, Petrobras has invested in managed pressure drilling (MPD) technologies to better manage its well construction challenges. The operator has recognized that, in some extreme cases, pressurized mudcap drilling might be the only approach to complete the well. Team training, new business models to reduce technology costs, enhanced computer models and better automatic control strategies are examples of areas of competence that received investments.

IOC Interest

S&P Global Platts notes that while Petrobras is by far the largest producer in the country, at around 75% of total Brazil crude output, foreign operators such as Shell, Equinor, Galp and Total are increasing their production even as auction acquisitions from the likes of BP and ExxonMobil point to more activity ahead.

Shell, in fact, is second only to Petrobras in oil and gas production in Brazil. The international energy company has been a big player in the pre-salt auctions as part of a strategy to develop its portfolio of pre-salt acreage through exploration. In the final production-sharing auction of 2018, the company acquired a 50% stake and operatorship in the Saturno pre-salt block in the Santos basin, sharing the cost of the $390 million signing bonus with partner Chevron. The move brought Shell’s total net acreage off the coast of Brazil to approximately 2.7 million acres.

According to Robin Hartmann, Wells Operations General Manager for Shell Brasil, the company plans to drill four wells in its deepwater assets in Brazil this year. In the Campos basin, this includes two development wells in the Parque das Conchas (BC-10) asset and one exploration well in Alto do Cabo Frio, the first for this offshore field. The company will also drill one appraisal well in Gato do Mato in the Santos basin, the third well for this asset. The Gato do Mato drilling is planned to start in June and take 130 days, including a well test. The company will use advanced geosteering technologies for landing and drilling the reservoir section on BC-10 and may need to add MPD for the Alto de Cabo Frio Oeste exploration well, Mr Hartmann said.

The 2019 drilling campaign will be executed by Brazil-based Constellation, formerly QGOG, and its sixth-generation drillship Brava Star. The campaign marks a return to development, exploration and appraisal work for Shell Brasil, which last year tasked its wells team with performing primarily light and heavy workovers.

“One of the main challenges for the drilling campaign will be working with a new team comprising Shell Brasil, Constellation and Halliburton, which is providing integrated drilling services and completion equipment,” Mr Hartmann said. “Other challenges include a variety of activities such as an open-hole gravel-pack on BC-10, the well test on Gato do Mato and drilling an exploration well in Alto de Cabo Frio Oeste with potential losses.”

Drillers Look Beyond Petrobras

For Constellation, the 2019 drilling campaign for Shell is its first deepwater partnership with the oil major. Constellation Commercial Manager Thiago Schimmelpfennig described the contract as a “huge opportunity” to demonstrate the company’s potential to international operators.

Petrobras has kept Constellation’s fleet busy in the past, but the last of their long-term contracts expired at the beginning of 2019. The reduction in the scope of Petrobras’ operations in recent years has encouraged Constellation to diversify its client base and compete for contracts outside Brazil. “We see a lot of opportunities happening in Brazil, but not only here,” Mr Schimmelpfennig said.

In addition to drilling for Shell, Constellation will also drill for Queiroz Galvão Exploração e Produção (QGEP) in Brazil in 2019. Its Laguna Star, a sixth-generation ultra-deepwater DP drillship with a maximum drilling depth of 40,000 ft and operating water depth of 10,000 ft, will drill the third well for QGEP’s early production system in the Atlanta field. The rig may also potentially conduct some intervention activities. In addition, Total Brasil recently contracted Constellation’s Amaralina Star, a sister rig of Laguna Star, for up to two wells in the Lapa field, with a maximum expected duration of 140 days, starting in late February.

Outside Brazil, Constellation’s deepwater semisubmersible Olinda Star is into its second year on the company’s first international venture, an ONGC project offshore India. Constellation’s offshore fleet also includes a midwater semisubmersible (Atlantic Star) and three sixth-generation, ultra-deepwater, DP semisubmersibles (Alpha Star, Lone Star and Gold Star).

Mr Schimmelpfennig said the company is optimistic about future offshore opportunities in Brazil as more international operators enter the market. The company keeps part of its offshore fleet warm stacked and ready to go. Although its fleet also includes nine onshore drilling rigs – including four conventional and five helicopter-transportable rigs – the company sees few onshore opportunities in the near future and currently has its onshore rigs stacked. However, they are ready for rapid deployment if needed, he said. Constellation’s last onshore operation in Brazil terminated in October 2018.

When new operators enter the market, new competitors come, as well, which makes it increasingly important for domestic companies to find ways to differentiate themselves, Mr Schimmelpfennig said. For Constellation, that means promoting its operational safety culture and technological alignment.

In order to do so, the company developed its remote operations center, which puts integrated data from all operating drilling units into the hands of experienced drilling engineers, who can follow up on the operations and assist offshore crews to improve process safety.

The center deploys AI and proprietary algorithms to identify a wide range of situations around the rigs, including barrier integrity management. The algorithms monitor hundreds of key performance indicators, which can trigger alarms and allow detailed after-action review exercises to improve the processes.

“We are one of the few companies in Brazil that has a remote operations center,” Mr Schimmelpfennig said. “The center provides real-time data and processing that enables us to gather and combine information from different systems, like the rotary drilling system, BOP and dynamic positioning system. With this data, we can identify risks like emergency disconnect sequence selection versus current operation being performed, mud volume control during tripping operations, and riser safety margin, among others.”

Another experienced Brazilian driller that is repositioning for opportunities at home and abroad is Ocyan, formerly Odebrecht Oil & Gas. Its fleet of DP rigs is working solely for Petrobras in 2019, though it does have one semisubmersible, the Norbe VI, warm stacked and ready for new contracts. The company will have four sixth-generation drillships (ODN I, ODN II, Norbe VIII and Norbe IX) and one fifth-generation semisubmersible (ODN Delba III) active for Petrobras in the Santos and Campos basins.

The drillships – which can drill in up to 3,000 m of water with a drilling depth capacity of 10,000 m – are supporting an exploration campaign while the semi is doing production and workover jobs. The semi can drill in waters of up to 2,400 m with a drilling depth capacity of 10,000 m. It will roll off contract in August, while the drillships will finish their contracts in 2021 and 2022.

Ocyan’s Vice President of Drilling, Heitor Gioppo, described 2018 as a challenging year for drilling contractors, whether in Brazil or overseas, and predicts more of the same in 2019.

“The marketing is picking up, but the pace is slower than everybody had foreseen some months ago, so we still see 2019 as a challenging year,” he said, describing the sector as in survival mode. “We believe 2020 will be better, but it depends on the oil price and how fast the oil companies will come back to deepwater.”

Currently, 70% of Ocyan’s business comes from its drilling operations, but Mr Gioppo said the company foresees faster growth from the production/FPSO side of its business, boosted by potential new projects in the near future and by initiatives such as a joint venture on innovative composite riser technology.

Ocyan isn’t waiting passively for things to improve. The company redesigned its strategic plan two years ago to support expansion of its services to other geographical areas. It’s also been taking steps to make itself more appealing to international operators, such as extensive ISO certification covering its management of people, safety and asset integrity. For a company intending to operate in locations around the globe, having ISO certification is a plus, Mr Gioppo said. “At the end of the day, what we’re aiming for is to deliver a better service.”

Outside the Pre-salt

While much of the excitement about Brazil’s future growth is focused on the pre-salt polygon, Brazil’s largest independent oil producer, PetroRio, is staying true to its focus on generating value from mature producing fields. The company will drill three production wells in 2019 in the Polvo field, its fully owned asset in the Campos basin. Drilling will start probably in May and finish in November or December, depending on the results. PetroRio is planning to introduce multilateral drilling to Polvo for the first time.

“This will bring a little complexity to the operations,” said Francisco Francilmar Fernandes, Wells Engineering Manager for PetroRio. He added that the company may drill two additional wells this year if the initial three produce good results. The company drilled three successful wells in Polvo last year, which boosted production by 60%.

“That’s what we’re working to this year,” Mr Fernandes said, adding that production is now approximately 10,000 bbl/day. “If we can repeat the results, that would be great.”

While focused on its shallow-water assets in 2019, PetroRio is also planning for its first drilling efforts in Brazil’s deepwater next year. In January, the company announced it had entered into a share purchase agreement to acquire an operating stake from partner Chevron in the Frade field, bringing PetroRio’s working interest to 70%. According to PetroRio, the transaction will nearly double the company’s total production to approximately 28,000 boepd.

While the company uses a land rig on a fixed platform for its Polvo work, it will require a semisubmersible for its Frade drilling campaign, Mr Fernandes said. He expects the company will put out tenders for that work in late 2019 or early 2020.

PetroRio also has assets in the Foz do Amazonas but has no plans to drill there in the near future. “We will see what happens with the other operators that are working and try to figure out the situation with environmental licences,” he said.

To survive in the downturn, PetroRio has reinvented itself by turning its focus from exploration to production. It has also worked to improve its operational efficiency – which Mr Fernandes said is now above 98% in the Polvo field – by focusing on performance and partnership with key contractors. “We have to work on reducing the cost of the whole operation including wells and drilling,” he said. DC