Oil & Gas Markets

US Lower 48 oil production likely to slow considerably after hitting new highs in 2023, new analysis shows

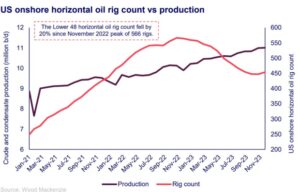

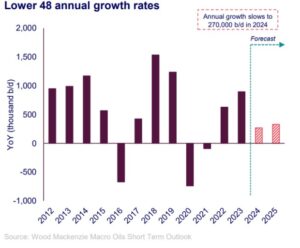

US Lower 48 oil production growth exceeded expectations in 2023, adding 900,000 bbl/day despite inflationary pressures, private consolidation and declining rig activity. However, the repercussions of these decisions will impact future supply as the region is poised for much lower growth in 2024 and beyond, according to a report from Wood Mackenzie. The firm projects Lower 48 oil production will grow by 270,000 bbl/day in 2024 and 330,000 bbl/day in 2025.

“This is mainly a function of the lag between spud and first production,” said Senior Analyst Utkarsh Gupta. “Offsetting base declines gets increasingly difficult at higher production levels, resulting in more production needed just to keep production flat. Additionally, high-growth privates have been acquired, and cost inflation prompted remaining small privates to cut rigs.”

“The pre-COVID high watermark of 10.5 million bbl/day in December 2019 was exceeded in May 2023,” said Principal Analyst Nathan Nemeth, noting that Lower 48 production eclipsed 11 million bbl/day in November 2023. Efficiency gains played a key role, with some E&Ps reporting 5-15% drilling gains for 2023 compared with 2022. “However, efficiency gains and associated well cost savings are not translating into more drilling activity like we’ve seen in the past. Instead, E&Ps have reiterated plans to return cash to shareholders.

“Lower 48 production growth will be lower, but several factors could influence by how much, such as improving Permian well performance and further efficiency improvement,” he continued. “In a sustained higher price environment, the Lower 48 has proven able to add sizable volumes.”

UK report gauges workers’ perceptions of oil and gas

The oil and gas sector is at risk of failing to deliver the 28,000 skilled engineering construction workers needed by 2030 unless it better understands what motivates new entrants, according to a report from the UK’s Engineering Construction Industry Training Board. Its career motivations study, conducted in 2023, shows that the sector is struggling to appeal to the general population and, in particular, young people and women.

The report provides a snapshot of what motivates career choices and of perceptions of the engineering construction industry’s (ECI) different sectors, including oil and gas.

Findings show workers who are already in the ECI view the oil and gas sector much more positively than the general population. When asked whether they would consider a career in the oil and gas sector, 55% of ECI workers or learners said yes, but this figure was down at 17% for the wider population, with 49% saying no.

The report highlighted that oil and gas ranked bottom of the seven ECI sectors for those ages 16-19 in the general population, with only 15% saying they would definitely consider a career in the sector and 58% answering no. These figures were similar when broken down by gender. Only 14% of women outside the ECI said they would consider a career in oil and gas, with 58% saying they would not join the sector.

The oil and gas sector is the largest in which engineering construction contractors operate, accounting for 32% of the ECI workforce in 2023.

The report recommends the sector “consider its image and representation outside of the ECI before attempting further recruitment efforts along current paths.”

It also suggests the sector might be more successful concentrating recruitment efforts from within the ECI community, rather than attempting to win over a wider public.

Other recommendations include better communicating the high rates of pay in oil and gas and using ambassadors and alumni to raise awareness, such as at schools, colleges and job fairs, to change the perception of the sector.

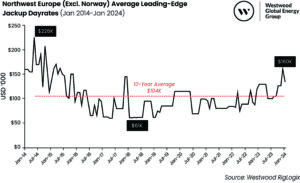

North Sea’s falling jackup supply drives marketed utilization rate up to 94%

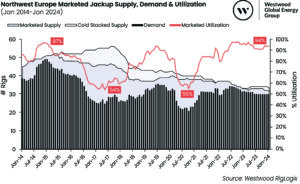

The North Sea’s jackup marketed utilization has been on an upward trajectory since 2017, except for a blip in 2020. However, the main driver behind this trend is not demand but a shrinking fleet.

In an analysis by Westwood Global Energy Group Senior Rig Analyst Kathleen Gammack, she noted that committed utilization of the marketed fleet here was 54% in February 2017 – 25 committed out of 46 units. By year-end 2023, utilization had hit 94% – 30 committed rigs out of a marketed supply of 32 units.

In the North Sea, while dayrates have been trending up, simply due to where the market is in the cycle, they have been lagging behind some other regions. Combined with factors like challenging tax regimes, the lack of certainty in the North Sea has driven drilling contractors to bid into regions that are offering longer duration programs, often with higher dayrates.

With the outlook for the year ahead looking somewhat flat, Ms Gammack suggested that drilling contractors may consider moving their harsh-environment units elsewhere if the contract term and economics make sense. However, if further rigs leave for multi-year campaigns elsewhere, there may not be enough capacity in the North Sea to fulfill some of the longer-term carbon capture and storage and P&A campaigns being planned, which could come to fruition from 2025 onwards.

Market likely to absorb shift in Saudi Aramco strategy to boost production capacity

The Saudi Ministry of Energy’s recent instructions to Saudi Aramco to abandon its 13 million bbl/day target and maintain 12 million bbl/day should not cause a tightening in the supply and demand balance during this decade, according to Wood Mackenzie analysis. Ann Louise Hittle, Vice President of Oil Markets, cited the firm’s forecast for oil demand to peak in 2030.

For H2 2023, Saudi Arabia’s crude oil production averaged 9 million bbl/day, and this level is projected to continue for H1 2024, with an average of 9.1 million bbl/day. This will leave Saudi Arabia’s spare crude production capacity at 3 million bbl/day. “With spare capacity higher than usual and a persistent need to reduce production, this is an astute time to abandon the 13 million bbl/day capacity target,” Ms Hittle said.

Alexandre Araman, Principal Analyst, Upstream for Wood Mackenzie, added that recent cost increases in the industry and pressure on prices likely factored into the decision, as well.

Aramco is already heavily investing in oil megaprojects at Zuluf, Marjan and Berri, along with infill drilling at its legacy fields.

“To increase capacity to 13 million bbl/day, other expansion projects, such as Safaniyah and Manifa, as well as the commercialization of new discoveries, are more than required,” Mr Araman said. “But costs have substantially increased since the pandemic, and it makes less sense now for Aramco to go after projects that are getting more expensive.”