Oil & Gas Markets

Lower demand could drive 20% slip in European gas prices by next summer before rebounding in 2025

While the European gas market has seen a tightening recently due to the extensions of gas field maintenance schedules in Norway and strikes at key Australian LNG fields, Wood Mackenzie is forecasting that European gas prices will fall by 20% by mid-2024, compared with the current forward price curve.

Factors include storage reaching as high as 96% at the end of October, as well as a softening of demand for gas in the power sector.

“The Norwegian maintenance schedule being extended could have had a serious impact if storage levels were not so high,” said Mauro Chavez, Research Director, European Gas and LNG markets. “And while the strikes in Australia will ripple across the global LNG market, it is more likely they will be short-lived, limiting the implications on Asian and European market balances.”

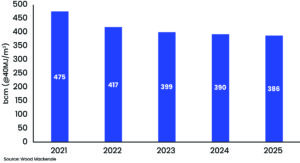

Wood Mackenzie forecasts a further reduction of 9 bcm in overall gas demand in 2024 (or 2.2% year-on-year), mainly materializing in the power sector. Gas in power is expected to decline by 12% year-on-year in 2024, a similar decline to that of 2023, caused by an increase in renewable capacity, improved nuclear performance and still relatively weak electricity demand. The anticipated rebound in industrial and residential demand will also fail to fully materialize, given challenging economic factors.

The view of balanced European markets and downside on prices for 2024 relies on a normal-weather assumption for winter 2023/2024 and next summer. Weather will play a key part on how markets will balance, with Wood Mackenzie warning that a cold winter would lead to additional demand of more than 20 billion cu m and see gas storage levels fall to 26% by March. If Europe fails to achieve its 90% storage target, there could be substantial upward pressure on prices. However, forecasts of an El Niño year suggest there is a higher chance of a warmer-than-average winter across Asia and Europe. That would risk putting further downward pressure on prices.

In 2025, however, the market could tighten once again. “In 2025, the European gas balance will get tighter due to Russian imports through Ukraine stopping as the transit agreement expires,” Mr Chavez said. “The market anticipates a big drop in prices in 2025 on the expectations that more LNG supply will be available. However, we think this is overplayed as it will take time for supply to ramp up, while LNG demand in Asia will increase.”

DNV report: In absolute terms, renewables have yet to begin replacing fossil fuels

Renewables are still just meeting increased demand, rather than replacing fossil fuels, according to DNV’s Energy Transition Outlook. Further, in absolute terms, fossil fuel supply is still growing.

“Globally, the energy transition has not started, if, by transition, we mean that clean energy replaces fossil energy in absolute terms,” said Remi Eriksen, Group President and CEO of DNV.

Energy security has strengthened as a driver of energy policy due to changes in the geopolitical landscape, the report noted. This means governments are willing to pay a premium for locally sourced energy. For example, the Indian Subcontinent is now forecast to transition slower with more coal in the energy mix.

However, the report also forecasts that, from now on, most energy additions will be wind and solar, which will grow 9-fold and 13-fold, respectively, between 2022 and 2050. Electricity production will more than double between now and 2050. The fossil to non-fossil split of the energy mix is currently 80/20, but this will move to a 48/52 split by mid-century.

Solar installations reached a record 250 GW in 2022. Wind power will deliver 7% of global grid-connected electricity, and installed capacity will double by 2030, despite inflationary and supply chain headwinds. However, in the near term, transmission and distribution grid constraints are emerging as a key bottleneck for renewable electricity expansion and related distributed energy assets, such as grid-connected storage and electric vehicle charging points in North America and Europe.

“There are short-term setbacks due to increasing interest rates, supply chain challenges and energy trade shifts due to the war in Ukraine,” Mr Eriksen said. “But the long-term trend for the energy transition remains clear: The world energy system will move from an energy mix that is 80% fossil based to one that is about 50% non-fossil based in the space of a single generation. This is fast, but not fast enough to meet the Paris goals.” DNV estimates CO2. emissions in 2030 will be only 4% lower than today.