Supply/demand imbalance, cost increases emerge as potential barriers for global offshore markets heading into 2014

By Joanne Liou, associate editor

Falling demand and rising supply suggest a potential near-term perfect storm for E&P, but long-term fundamentals remain sound, analysts report. The US continues to see phenomenal growth in raw crude and natural gas liquids production – up by 1.5 million bbls/day year over year, according to Raymond James & Associates. Coupled with growth in Canada, global oil supply is surging. Even worse, oil demand is growing at only about half the pace of supply growth. “You go back over the last two decades prior to 2007, and we’ve grown global demand roughly a million and a half (barrels) a day,” Marshall Adkins, managing director of Raymond James & Associates, said. “But now you’re in the midst of this global deleveraging. The global economy and oil demand are only growing about half the rate it did a decade ago.”

Oil demand around the world is growing by 700,000 to 900,000 bbls/day, Mr Adkins stated, which is approximately half the rate of North America’s current supply growth. “You cannot continue to have oil supply growing twice as fast as demand and not put downward pressure on oil prices.” The question is why is oil $100-plus?

Mr Adkins attributes that to the unplanned removal of more than 3 million bbls/day of production from various Middle Eastern and North African countries over the past couple of years. Libya and Iran together have accounted for more than 2 million bbls of lost oil supply in the past three years.

“As long as you’re going to have massive supply interruptions, the price of oil can hold up near term,” he said. “But if those interruptions are reversed, global oil supply will quickly outpace demand, and oil prices will fall in 2014.”

Uncertainty remains in the Middle East supply but is being somewhat offset by North America’s production growth, Mr Adkins continued. If there are no more supply interruptions, then the futures strip reflects the oversupply and already suggests a fall in the price of oil to rebalance the global oil supply/demand equation. “The futures curve for the next three to four years says oil prices are going to fall some $25 or so,” he noted.

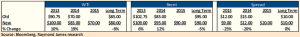

In a September report, the Raymond James group forecasted $100 WTI and $109 Brent averages for 2013. For 2014, it forecasted WTI price index as $83/bbl and $95/bbl Brent, followed by $70 and $90, respectively, for 2015. Lower oil prices should not spell disaster for US oil and gas companies, however, since rising production rates will offset much of the negative impact from lower oil prices, Mr Adkins added.

Simultaneous to the growing uncertainty in supply/demand, drilling costs

continue to rise, in part due to tax increases being imposed by some governments. This is particularly an increasing burden for deepwater projects around the world. By 2017, the deepwater share of global offshore capital expenditure is expected to rise to 53% from 38% in 2012, according to Infield System, an energy research and analysis firm.

“As the shallow-water offshore areas of the world experience a decline of production, we are seeing a move into more challenging situations. There are structural costs to be faced in terms of reservoirs that have never been tackled – the geology itself, pre-salt reservoirs, HPHT, deeper payload, more complex situations. We are moving into more remote locations, extreme conditions in ultra-deepwater and in the Arctic,” John Westwood, chairman of Douglas-Westwood, said. “In addition, there is the major challenge of underlying cost inflation in terms of both hardware and people.”

“These cost issues have to be addressed because you can’t spend more and more dollars for less and less oil,” he added, noting that rising costs have already led to project delays. “We’ve seen some evidence of this with one or two major offshore projects having been deferred,” Mr Westwood added.

A tax increase, for example, prompted Statoil to defer the Johan Castberg project in the Barents Sea in August. Norway’s government increased its special petroleum tax to 51% from 50% while limiting tax-deductible income from 30% to 22%.

In September, Total announced a 14% capital expenditure cut over two years, from $28 billion in 2013, and “their share price went up 15%,” Mr Westwood said. Shell has stopped providing forward production guidance and is focusing on “cash flow growth,” he continued. Shell CEO Peter Voser has stated that he is unsure if the company would return to Alaska in 2014 or 2015. “The flip side of this situation is the major opportunities for drilling contractors that can offer cost-effective solutions,” he said.

The Golden Triangle

The Golden Triangle – West Africa, Brazil and the US Gulf of Mexico (GOM) – continues to have a positive forecast and account for a bulk of the drilling industry’s capital expenditure. West Africa is leading the way in exploration activity for the continent, while countries relatively new to the scene – Sierra Leone and Liberia – may present competition in the future. Globally in the next five years, deepwater capital expenditure is expected to total $223 billion, of which $78 billion will be on the drilling and completion of subsea wells, Mr Westwood said. Douglas Westwood defines deepwater as deeper than 1,640 ft (500 meters). “Of that $223 billion, the Golden Triangle is $174 billion.”

West Africa

In the Middle East and Africa, offshore drilling expenditure is expected to climb from nearly $14 billion in 2012 to $17 billion in 2016, according to GBI Research. With 22 offshore discoveries between 2008 and 2012, Angola is expected to remain the biggest draw for drilling expenditure, but Ghana is quick on Angola’s footsteps. It had 16 offshore discoveries.

In Angola, Infield Systems anticipates Total’s Kaombo, Chevron’s Lucapa and BP’s PAJ prospects to command the most significant expenditure leading to 2017. However, activity in East Africa is drawing more attention as well, especially offshore Mozambique. “There have been some recent reasonable finds and a lot of corporate activity with India,” Mr Westwood noted. In June, OVL and Oil India jointly signed definitive agreements with Videocon to acquire 10% participating interest in the Rovuma fields offshore Mozambique. In August, ONGC signed a definitive agreement with Anadarko to acquire a further 10% stake in the project.

Brazil

Brazil will remain a leading deepwater market, with investments leading up to 2017 revolving around the Lula and Franco developments, according to Infield Systems. Both are in the pre-salt Santos basin.

In March, Petrobras announced a 10-year energy plan to expand oil production to more than 5 million bbls/day by 2021 and targets more than 2.25 million bbls/day of oil exports by the same year. As of August, the company’s oil output, including natural gas liquids, was averaging 1.9 million bbls/day.

In October, Petrobras mobilized its first TLP into the country as a new approach to field development in Brazil. Atlantica’s Beta, a semi-tender that features a semisubmersible hull with a modular drilling package, will soon begin a four-year contract for development drilling on the Papa Terra field in the Campos Basin. “There are a lot of TLPs and spars in the Gulf of Mexico, but this is the first TLP for Brazil with dry trees, and the Beta is the first semi-tender to enter the Brazilian market,” Kerry R. Kunz, CEO of Atlantica, said. “There are, no doubt, other prospects in Brazil for TLPs and the use of semi tenders.”

Gulf of Mexico

The GOM deepwater market is expected to continue growing, though not at the pace of the two other, less mature, regions of the Golden Triangle. The EIA forecasts GOM offshore production will average 1.3 million bbls/day in 2013 and 1.4 million bbls/day in 2014.

According to Infield Systems, Shell holds a 24% share of total capital expenditure on deepwater developments in the region, with the ultra-deepwater Stones and Appomattox projects expected to be central to its investment. Production from Stones’ first phase of development is targeted for 2016, according to Shell, and will consist of two subsea production wells tied back to an FPSO vessel and host facility.

Atlantica foresees growing deepwater applications in the GOM for semi-tenders. “We’re going to start a campaign for the marketing and business development (of semi-tenders) to concentrate on the Gulf of Mexico because we believe that’s a potential market,” Mr Kunz said. A semi-tender can scale down the size of the TLP or spar and “offers the operator a massive saving in capital investment upfront. Instead of having a large platform rig, the operators hire a semi-tender, as it has the minimal amount of equipment onboard the platform,” he explained.

The modular mast equipment package sits on the operator’s platform, and a minimal amount of weight is imposed on the platform. “All the third-party supplies – drilling consumables, personnel, power generation, drilling fluids, etc – sit on the tender, which acts as a support to the drilling rig.”

There’s also a clear safety benefit, Mr Kunz said: the semi’s ability to pull away from the platform. “Personnel are housed at a safe distance away from the drilling and the production equipment because they are at the other end of the semi, and

in the event of an incident occurring on the platform, TLP or spar, we simply can pull away very efficiently and very quickly with the forward mooring winches.”

EPL Oil and Gas exclusively focuses on the GOM’s central shelf region, using units ranging from barge rigs to shallow-water jackups and platforms to work in water depths from five to 20 ft. Its wells average 10,000-ft depths. Many of EPL’s wells have characteristics of both development and exploration, Gary Hanna, chairman, president and CEO, explained. “One of the benefits we have of playing in the central Gulf of Mexico is that it’s very oily and that we tend to have a lot of stacked pay. It’s somewhat of a luxury for us to be able to drill several development targets on our way down to see an exploration well.” Approximately 50% of EPL’s capital budget is geared toward projects that add reserves.

As of September, the company was operating three 200-ft, mat-cantilever jackups from Hercules Offshore running on 180-day terms and an additional one in partnership with TANA Exploration. Although the current terms will end in Q1 to Q2 2014, “we will just keep them going as we normally do,” T.J. Thom, senior vice president and chief financial officer for EPL, stated. “We’ll maintain consistency, maybe increasing our fleet by one or two on average.”

In some areas where barges and cantilever jackups are not suitable, EPL uses platform rigs. “Our newly acquired South Pass 78 area is an example of a field where it is best to use a platform rig,” Mr Hanna explained. “When we go on with a platform rig, to execute the program with the highest degree of efficiency, we tend to clump wells together. We prefer to do five to 10 projects back to back because of the mobilization time and cost.”

EPL, which generally contracts rigs for six- to 12-month drilling programs, has doubled its jackup fleet year over year and with longer terms. The company was running approximately three rigs in the last year but is now averaging five and plans to increase to six or seven in 2014. “We’ve seen a progressive step up as to how we’ve executed not only the platform side but basically the jackup side, as well,” Ms Thom added. “We used to do more commonly three wells or 90-day terms. We’re routinely now at 180 days and keeping them longer.”

EPL’s capital expenditure also reflects its rig count increase, going from $60 million in 2010 to $330 million this year. A further increase in its 2014 capital budget is expected, Mr Hanna said. In November 2012, EPL acquired Hilcorp Energy’s shallow-water GOM shelf oil and natural gas assets for $550 million. In the coming year, Mr Hanna foresees additional funds being directed toward those assets.

Hilcorp Energy’s shallow-water GOM shelf oil and natural gas assets for $550 million. In the coming year, Mr Hanna foresees additional funds being directed toward those assets.

“We work through those assets with a reprocessed data set that takes nine months to a year to do the science work required to generate a larger basket of high-quality projects,” he said. He described this year’s Hilcorp expenditures as a relatively light spend, estimated at $100 million. “You will see that accelerate in 2014 and 2015 as these projects mature and that basket gets larger and larger.”

Reform potential in Mexico

Potential changes are on Mexico’s horizon as its Congress considers constitutional amendments that would overhaul the country’s state-run oil sector. Currently, PEMEX controls 100% of Mexico’s oil/gas market, allowing only compensation to private-sector companies on a set fee per unit of work or unit of production. Mexican President Enrique Peña Nieto of the PRI party submitted a proposal to Congress in August to amend the constitution to remove restrictions on who can carry out activities within the domestic energy industry. For the first time since the country nationalized its oil sector in 1938, under the proposal, Congress would be empowered to legislate energy policy with no constitutional constraints.

“The constitutional amendment proposed by the president would clean the slate completely and eliminate all restrictions to what Congress would be authorized to do concerning who can carry out exploration and production activities,” Jose Valera, partner of law firm Mayer Brown, said. “If the constitutional amendment is approved, Congress could be authorized to pass laws that provide, for example, that PEMEX is no longer a monopoly.” Mr Valera represents oil and gas companies negotiating exploration and production contracts in the US and South and Central America and has counseled governments on matters regarding energy legislative reform.

The Mexican Congress is debating the proposal and could approve it by the end of this year. According to experts, the next step before full effectiveness is the ratification of the amendments by a majority of the states, which could happen by the end of Q1 2014.

Mexico potentially possesses considerable hydrocarbon resources in the deepwater Gulf of Mexico that have not been commercially developed. PEMEX estimates the Mexican GOM could hold as much as 27 billion bbls of oil of potential resources. In the past five years, PEMEX’s monthly petroleum statistics show domestic crude oil production has declined from 3.8 million bbls/day in 2008 to 2.5 million bbls/day in 2012. “The conventional proved reserves of the country have come down; the production of the company has come down. The exports of the country have come down, and the imports have come up. All the current trends point to the wrong direction,” Mr Valera stated.

President Peña Nieto contends that if his proposal is approved and Congress opens the energy industry, reserves could be replenished at a rate greater than 100% of production. Production of crude oil would go up from 2.5 million bbl/day to 3 million in 2018 and 3.5 million in 2025, according to the proposal. In the case of natural gas, production would go up from 5.7 bcf today to 8 bcf in 2018 and 10.4 bcf in 2025. “These projections can be overstated or understated because the actual increase of production, which in turn will be the result of an increase in drilling activity, will depend on the terms and conditions of the new contracts to be awarded, the frequency with which new contracts will be awarded and the number and location of areas that are going to be made available,” Mr Valera said.

A main purpose of the amendment is to increase exploration drilling and production from both conventional and unconventional resources, thus creating opportunities for drilling contractors in the deepwater portion of the Mexican GOM and in shale oil and gas resources onshore. “That would lead to very meaningful additional business for drilling contractors. Potentially, the rig count in Mexico could more than double by the end of this decade,” Mr Valera noted.

Congress formally commenced debate on the proposal in September. The likelihood of approval is higher than ever, he continued, because two of the three major political parties in Mexico are in favor of the reform. Energy reform proposals by the two prior Mexican presidents did not have broad, multiparty support.

“The PAN and the PRI have the necessary majorities in Congress to pass the constitutional amendment, so the alignment of political support hasn’t been as strong before as it is now.”

Asia Pacific

The potential for the South China Sea has been driving much of the offshore activity for China, Mr Westwood stated. Estimates released in 2012 by China National Offshore Oil Co (CNOOC) stated the South China Sea holds approximately 125 billion bbls of oil and 500 Tcf of natural gas in undiscovered resources. US EIA estimates are much more conservative, at 11 billion bbls of oil and 190 Tcf of natural gas in proved and probable reserves.

Either way, as the world’s most populous country and the largest energy consumer, China will doubtless continue to impact energy markets through its increasing energy demand. According to the EIA’s August 2013 Short-Term Energy Outlook, China’s net oil imports will exceed those of the US by 2014 on an annual basis, making it the world’s largest oil importer.

In Southeast Asia, although most offshore drilling remains in shallow water, activity is expanding to deepwater. “We’re looking at a five-year CAPEX of $1.62 billion in 2012 growing to $5.2 billion in 2017, and we expect around 160 development wells are to be drilled and completed over the 2013 to 2017 period,” Mr Westwood said.

However, one regional challenge is available deepwater technology and rigs. Deepwater rigs within the region haven’t advanced much in recent years and are increasingly reaching their technical limits in terms of water depth. “This situation cannot continue, and as the demands of deepwater drilling kick in, we expect more high-spec rigs to be moved into the region,” Mr Westwood said. Read more about the Asia Pacific region on Page 80.

Europe

With fresh development projects set to kick into gear over the next two years, Norway will continue to be a key offshore oil and gas destination in the near future, according to GBI Research. “(Europe’s) offshore drilling expenditure will increase steadily at an average annual growth rate of 6.9%, from approximately $10 billion in 2012 to $12.8 billion in 2016,” according to the intelligence provider. Norway is expected to account for $5 billion of that, followed by the UK with $4 billion.

Prospector Offshore Drilling has been monitoring field developments and re-developments in the UK sector of the Central North Sea. The company is targeting harsh-environment drilling and has secured two contracts with Total E&P UK for HPHT drilling on the UK Continental Shelf. The first two-year contract for the high-spec jackup PROSPECTOR 1 is scheduled to commence in January 2014 and has an option for two additional years. Delivery of the PROSPECTOR 5, another high-spec jackup, is expected from Shanghai Waigaoqiao Shipbuilding Co in China in early Q2 next year. Its contract with Total E&P UK is also for HPHT drilling in the UK Central North Sea under a three-year contract, and there’s an option for two additional years.

Rig specifications

Approximately 15 months ago, the industry had 88 jackups under construction. Since then, that number has increased by 35% to 119, with 30 deliveries expected in 2014 and 49 in 2015, according to a Noble Corp presentation in September. Contrast this to 2012, when only one jackup was expected for delivery in 2015. “Forty-eight units have been added in the short 15 months,” Roger Hunt, SVP-marketing & contracts for Noble, said during an analyst presentation in New York.

The demand for high-spec, harsh-environment rigs is driving business for many contractors, including Prospector. “There is a demand in the Arabian Gulf, as well as in Southeast Asia, for high-pressure, high-temperature drilling. In Southeast Asia, rigs with HPHT drilling equipment, capable of operating in over 350 ft (107 meters) of water, are increasingly sought after,” Bill Rose, Prospector president and CEO, stated. “You see the demand for newer, better equipment in Mexico, and while none of these are harsh environments, the attributes associated with harsh-environment rigs, such as increased deck load, larger deck space and increased consumables capacity, are attractive in these markets.” These high-spec rigs often exceed the minimum requirements in certain operating areas. “The reality is that this additional capacity reduces the E&P company’s execution risk,” he added.

In addition to PROSPECTOR 1, the company has five high-spec jackups under construction. China’s Dalian Shipbuilding Industry Offshore Co (DSIC) is building PROSPECTOR 3, with delivery expected in Q1 2014. PROSPECTOR 5, 6, 7 and 8 are being built at Shanghai Waigaoqiao Shipbuilding Co, with deliveries from Q2 2014 to Q1 2016. All six rigs are based on the Freide & Goldman JU2000E design.

The high-spec jackups feature the latest-generation horizontal and vertical pipe handling systems. With enhanced sensors, digital controls and process automation, the equipment is faster, more robust and more dependable than equipment from even a few years ago. “We also have the latest-generation power distribution systems, and the engines and power management we use today are more efficient, reducing emissions per horsepower consumed,” Mr Rose said. The rigs are capable of operating in depths up to 400 ft and are outfitted for 2 million lb hookload capacity. They are equipped to drill wells up to 35,000 ft in HPHT environments and are equipped with a 7,500-psi mud system with three 22,000-hp mud pumps.

The global market for high-spec rigs through 2014 is tight, Mr Rose said. “Then, into 2015 and 2016, we still believe the market is very robust, but the fundamental thing is always commodity prices and E&P company confidence.”

For contractors, focus will remain on measures to reduce downtime and to ensure operational integrity. Noble believes it has turned the corner on downtime, particularly subsea downtime, while delivering seven newbuilds in the past three years. The company says that subsea BOP/LMRP has accounted for an average 57% of total downtime in 2013, followed by 8% from top drives, Bernie Wolford, SVP – operations at Noble, said at an analyst presentation. As of September, the company has reduced subsea downtime, as a percentage of floater days, from approximately 10% in 2011 to under 8% in September.

“We’ve taken every sub-component that’s contributed to downtime, calculated how much downtime each causes us, and the 80/20 rule applies,” Mr Wolford explained. “Eighty percent of our downtime comes from just 20% of our components, and that’s the 20% where we’re devoting all of our effort.”

In September, Noble’s board of directors approved a plan to spin off its standard-specification drilling units into a separate offshore drilling company. These include five drillships, three semisubmersibles, 34 jackups, two submersibles and one FPSO, according to a Noble news release.

The contractor will continue to own and operate its high-specification assets, with particular operating focus on deepwater and ultra-deepwater markets for drillships and semisubmersibles, as well as harsh-environment and high-specification markets for jackups. “The purpose of the separation is for Noble to move forward with our development as a robust high-specification and deepwater drilling company through continued execution of newbuilds and fleet enhancements,” David W. Williams, who will remain chairman, president and CEO of Noble, stated in the news release. “By separating these two businesses, we believe each company will be able to better leverage the overall value of its fleet by focusing on the drivers of its particular business.”

In September, Jurong Shipyard delivered the first of six high-spec jackups it is building for Noble. The Noble Mick O’Brien is under contract with an undisclosed operator in the Middle East to drill one HPHT exploration well at $245,000/day. The rig can operate in up to 400 ft of water and drill up to 35,000 ft.

Hyundai Heavy Industries Co (HHI) is expected to deliver the ultra-deepwater Noble Bob Douglas drillship in October. It should begin operations offshore New Zealand for Anadarko by mid-December at $618,000/day. The rig will then mobilize to the GOM in June 2014 for another contract with Anadarko. The drillship is one of four that HHI is building for Noble; all are based on the Hyundai Gusto P10000 hull design, capable of operating in up to 12,000 ft of water and drilling to 40,000 ft.

Looking at the shallow-water side of the industry, Atlantica noted a growing demand for newer, safer and more efficient tender barges. “There’s growth, but there’s also fleet replacement,” Mr Kunz said. Formerly known as BassDrill, Atlantica has ordered two barges since its establishment in 2007. Alpha, its first tender barge, commenced operations in 2010 and is contracted to Total offshore the Republic of Congo until late 2015, with an option to extend. The barge can operate in up to approximately 656 ft (200 meters) of water. The Gamma, Atlantica’s second tender barge, is scheduled for delivery in Q3 2014 from the DSIC yard in China, and Atlantica is in contract discussions targeting the West Africa or Southeast Asia markets.

Mr Kunz foresees the barge fleet retirement continuing through 2014, as there are 12 units, representing almost half of the tender barge fleet, over 30 years old. Atlantica plans to continue to grow its fleet with both barges and semi-tenders next year but faces the challenge of finding builders and shipyards that offer attractive terms with the right capabilities. “You can’t go to one single supplier and get the entire unit (vessel and module drilling package). You can go to a shipyard, and they will build the barge or the semi-tender, but they don’t necessarily build the mast equipment package,” he explained. “You have to go to a specialized supplier, and then you have to bring the two pieces together.”

Atlantica is taking a slightly different approach with its fourth unit, Delta. Instead of building the unit in two locations, the entire vessel will be built in China. “US and European components will be supplied and shipped to China separately – the mast, drawworks, engines, top drive and other drilling components – and the whole Delta is going to be built and integrated in China,” Mr Kunz explained. He is optimistic this arrangement will yield time savings. The Delta shares the same design as the Beta and is being built at DSIC against a four-year contract with Total for work offshore west Congo. Operations should begin in Q3 2015 for a deepwater development project.

Industry leaders discussed deepwater challenges during a panel session at the 2013 ATCE in New Orleans in September. Click here to read web-exclusive article.