Subsea automation on path for closed-loop controls, intelligence

Subsea separation units, pumps and workover boost recovery rates; trend toward light well intervention picks up

By Joanne Liou, associate editor

Bradley Beitler is vice president of technology at FMC Technologies.

What are the challenges in your role at FMC Technologies? What do you see as the critical issues?

Our challenges are driving value for oil companies, and there are three main drivers. One is reserves. Anything that can enable an oil company to either create or find more reserves is a big value. Second is production. How can they produce those reserves faster? It affects their financial balance sheet. Third is cost. How can they lower the cost of finding and developing reserves and the capital cost of facilities?

The Lower Tertiary Wilcox trend in the Gulf of Mexico (GOM) is very deep, and it’s very expensive to drill these wells, but there are billions of barrels of oil in these reserves. Companies cannot access these reserves using conventional technology. Using technology that enables them to go into these formations and get the oil out is a huge value.

Industry is seeing very high temperatures and very high pressures in these wells and, as a result, is working on how to cope with pressures as high as 20,000 psi and temperatures as high as 400°F. If we learn to access those reserves, we as an industry or we as a company, have to really focus on the technical development to enable that access. That’s hitting that very top value driver.

For faster and more production, you think about increased oil recovery. On land, there are plenty of ways to keep production at a high level over the life of an oilfield. In 10,000 ft of water, it is more challenging. The industry is developing ways to take techniques from onshore and apply them in subsea environments. It is very expensive to bring a semisubmersible to a wellsite, and sometimes it is not economical to perform workover operations. Smaller boats, monohull type vessels, are very specialized and efficient in performing some of these maintenance tasks on wells that we are able to do on land.

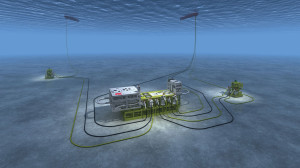

To make operations more cost effective, we have a vision in the subsea world that ultimately everything on the topside of a platform is going to be on the seabed. We think we’re going to have the wells, the processing of the crude, the polishing of the liquids and gas on the seabed and all go into a pipeline back to shore or to a storage location, maybe even an underwater storage location. We don’t think you’re going to see a lot of topside facilities in the future.

What are the benefits or reasons for putting topside facilities on the seabed?

There are hundreds of millions of dollars tied up in the structures to support topside facilities in the floating structures or platforms built to support those facilities. By putting them on the seabed you can cut those hundreds of millions of dollars out of that equation.

You also have a lot of people flying back and forth to these platforms. There are HSE issues with having personnel going on and off the platform. On the flip side, these subsea facilities have to be ultra-reliable and highly integral.

Industry is moving toward more ultra-deepwater activity. The factors of distance, pressure and temperature are exacerbating the challenges. Since cost is a critical issue, what can industry do to economically continue to go ultra-deep and produce from those fields?

It’s always going to be expensive to go ultra-deep, to drill through the salt and to drill through the formations into the payzones. There is technology being developed to try to increase penetration rates, decrease the cost of mud and decrease the cost of casing. Those things are going to have to be in place to make a significant impact.

Car manufacturers have proven you can get the cost of a very complicated mechanism to very low levels if you produce a mass amount. If you look at our industry, we have not been able to standardize equipment, such as subsea equipment, and because each oil company has their requirements and their way of designing things, we haven’t been able to standardize.

FMC Technologies, as a supplier, tries to meet those requirements, but fact is, when you only make one or two of something or if you only make 10 of something, you don’t have a lot of charter to get the cost down. We, as an industry, have to think very closely about standardization of such components and how we can, even across the industry and not just one supplier, standardize things like quality requirements and configurable interfaces to drop the hardware costs.

The other way to reduce cost is by designing things to be installed using very low-cost vessels. Considering the total cost of developing a subsea field in deepwater, the actual cost of the subsea hardware is about 8% to 10%, and the other 90% is made up of drilling, pipelines, topsides and installation costs. We can’t do much about the pipelines; we can do something about the drilling costs and the installation costs. Instead of bringing out a huge lay barge costing millions of dollars, if we can find ways of installing things with smaller vessels and use more multipurpose vessels without bringing specialty vessels, then that will cut the installation costs down for deepwater.

up of drilling, pipelines, topsides and installation costs. We can’t do much about the pipelines; we can do something about the drilling costs and the installation costs. Instead of bringing out a huge lay barge costing millions of dollars, if we can find ways of installing things with smaller vessels and use more multipurpose vessels without bringing specialty vessels, then that will cut the installation costs down for deepwater.

What challenges stand in the way of implementing standards for quality and components for the industry?

In the oil business, we are not short of opinions. Oil companies and the supplier organizations have opinions on how things ought to be built or look like or how they should be configured. Companies have proprietary ways of doing things, and that’s why they’re successful. It’s tough to get past some of that inertia within the oil companies and the suppliers to be able to standardize.

If we were able to only standardize things like quality requirements, that would be a great step forward.

A major operator concern is reliability and maintainability. How are you working with operators to improve those factors?

After Macondo, we had a lot of conversations with our customers about product integrity, reliability and pressure. As an industry, we’re probably behind compared with a lot of organizations, such as NASA, that have dealt with reliability and integrity for a long time. Macondo showed us what could happen if products and processes fail. We have turned inward and said, “What do we have to do to get ourselves on the same page with the aerospace guys?”

We’ve put in place several programs, a lot having to do with qualification of our products. API has a myriad of specifications that call for certain qualifications, certain products and certain applications. We rely on API to give us guidance on how we should qualify our products. What Macondo forced us to do is to look and say, “Is that enough? Should we be testing our products to the limit? What’s the most that it can endure? What’s the highest pressure or the most number of cycles? When does it start a wear pattern?”

We as an industry have gone back and started looking into our products with different eyes and determining when things actually fail, as opposed to testing it to meet API specifications for qualification. Coming out of this, industry will have a lot more reliable and robust products. We are investing a lot to re-qualify our products to make sure they’re fit for what we’re trying to do.

Because the process of qualifying products has evolved since Macondo, has the process of developing products evolved as well?

It made us look at our engineering processes. Some of the things we added to our process, we used to have failure mode and effect analysis, which considers the possible ways this product could fail. We are looking at all the ways it could fail and then taking the risks and mitigating them through the design or operational process.

As we get information from the field, we perform failure mode analysis, taking into consideration the information from the actual product performance. It’s almost like an online failure mode analysis. Also, we look at redundancy. If one thing fails, we have another way of doing things. Industry is looking at what levels of redundancy you need in systems.

Is the rate of developing these new technologies or processes keeping up with the growing energy needs and demands?

The advent of fracturing technology gave us a buffer because before producing oil and gas out of these shale zones became so prolific, it was up to deepwater, the Arctic and other areas to cover for the declines in the Middle East. Fracturing these formations is giving us a cushion to be able to do some of the things we’ve wanted to do in deepwater and really look at how we’re going to do these lower tertiary plays.

There is a lot of technology involved in fracturing, mostly on the reservoir side. Out of that came technology’s unintended consequences, one of which is the water, chemicals used and produced. That’s an area where technology still has to advance. We provide all the high-pressure equipment from the back of the fracturing trucks to the pumps, all the way to the flowback equipment on the other side and the cleanup. We’re working hard on the cleanup side; we have the fracturing stage down. There’s a lot of technology we have to bring into play to ensure that the water coming out of the other side meets those specifications.

To support the development of new technologies, what conditions or strategies do you need to keep that development going?

We need close cooperation with our clients. The user is everything. They understand their reservoirs, their wells, their strategy for production. Our job is to be aligned with directions they are trying to go. We talk to their executives and project managers, engineers, R&D to figure out what they are thinking and where they are going.

In the past 10 to 15 years, we’ve formed closely aligned relationships with our clients. That close alignment is the most important thing to make sure the technologies are advancing at the right pace.

In a 2010 interview, Tore Halvorsen, senior VP of subsea technologies at FMC, noted that the rate of recovery for subsea fields was about 10-20% lower than platform-based fields. How are the rates today? What advancements have been made to narrow the gap?

One of the leaders in increased oil recovery is Statoil. Previously, Statoil was getting about 35% recovery on their subsea wells. Their goal has been to achieve 55% recovery. Now, they report an average oil recovery rate of 50% and have aspirations to increase this to 60% on the Norwegian Continental Shelf. They have dedicated vessels operating in the North Sea that are constantly going over each well and doing wireline work, which is typically done on land for workovers, and they run tools in the well to scrape out scale and things like paraffin.

That workover increases flowrates. Land wells and platform wells recover more because you have access to the wellbore. You can run the wirelines; you can do the maintenance everyday if you need to. Subsea, in thousands of feet of water, you can’t do much.

Secondly, Statoil has incorporated subsea separation, separating oil, water and gas. It eliminates the hydrostatic head at the well, and because you have a whole column of fluids, it’s pushing down on the column that’s below the well and pushing it back into the formation. You eliminate that column of fluids; you have nothing pushing on the fluids to push it back into the well to make it produce more freely, and so the subsea separation has a lot to do with being able to let the wells flow more freely. Statoil is able to stimulate the production of the wells and increase recovery.

We’ve provided all of the subsea separation units to date, and we’ve installed them in five projects around the world. Our first was installed in 2007 in the North Sea. Separation, pumping and workover maintenance on a periodic basis are some of the strategies to try to pump that 35% to 50% recovery.

Do you foresee subsea separation becoming a more prominent strategy?

Yes. We just entered a joint venture with Chouest, based in the GOM. We’re taking the technology we developed in the North Sea, where we’ve gone into well maintenance, and we plan to move it to the GOM to do well maintenance with the installed subsea wells. You’re going to see more of these light well intervention vessels and more companies using subsea pumps. A combination of the pump, separator to separate the water and the light well intervention vessel used to maintain the wells will keep the production curve at the maximum possible.

Given those three factors, the pump, the vessel and separator, is there one in particular that you think needs more focus?

The actual well maintenance needs the most focus now. There are many ways to maintain a well through the wellbore. A wireline is used for simple tasks, but in the GOM, for example, there is a lot of sand produced. A problem with some of these wells is the sand that accumulates at the bottom of the well. Coiled tubing is necessary to circulate the sand out, but the light well intervention vessels today can’t handle coiled tubing. Industry needs to focus on how to get a very small vessel to use coiled tubing for these workovers. That gives industry about 90% of the capability you have on one end to work these wells over. That’s an area of focus that we’re working on.

How are technical limitations holding back the goals you have for your systems and products?

The environmental cleanup of water in relation to fracturing on land is a major one. Moving into the Arctic, we have to understand the environmental impact of what we’re doing. What’s the carbon footprint of a drilling rig? How can we do a complete subsea completion, for example, in the Arctic discharge free?

The challenges of ultra-high pressure are really formidable. In deeper water, the challenges of containing something like that and making sure you have the ability to contain it when Mother Nature throws something at you that you don’t expect, that’s going to be a huge challenge.

What can industry do to better prepare itself for more Arctic activities?

The Arctic is split among different countries, and every country is going to have their own regulations. It’s going to mean we’re going to have a lot of requirements for a lot of safety and redundancy.

An issue with the Beaufort Sea is the icebergs and how they scour the seabed. If you have a subsea completion sitting on the seabed and an iceberg comes along, that’s a problem. We had to dig “glory” holes down in the seabed, deep enough to where the subsea equipment was below the capability of an iceberg to scour the surface. It’s an expensive and time-consuming operation to dig these underwater holes.

In the subsea industry, we need to consider how can we have a more economic way of protecting ourselves against icebergs. If you go into the Russian Arctic, there are shallow-water plays where the ice actually goes all the way to the seabed seasonally. How do you protect yourself there? The same way, you have to dig a big hole and put a cover over it. It gets into some really interesting civil engineering challenges with how to protect the equipment in the Arctic. We need to protect against the integrity of ice, and ice is constantly moving, constantly expanding.

You also have to have the ability to maintain these subsea installations under the ice.

FMC Technologies recently installed equipment for Gazprom offshore Sakhalin Island, but they have ice six months of the year. We haven’t had to do any interventions, but under the ice, what do you do? One of the things we saw for the future was the need for robotics. As a company and industry, we may need robotics underneath the ice to do maintenance tasks.

How does FMC balance between the human element and automation?

When you have a subsea processing station sitting in 10,000 ft of water, 10 miles away from the facility, there are certain things because of what Mother Nature does – the constant flow, animals, things you encounter on the seabed. These systems, when separating things and pumping things, the flow has to be fairly consistent. You have a lot of valves opening, closing, throttling and making constant adjustments to the flow stream to make sure things are performing smoothly.

You can’t have somebody sitting 10 miles away looking at a TV screen. You have to have local intelligence and automation inside that subsea production station to handle routine operations immediately. We started on a path to design our own automation to do that for closed-loop controls and found out that was a time-consuming task. So last year we acquired Control Systems International (CSI).

We had designed the automation for a processing system two to three years ago, and it took four engineers six months. We went to CSI, and they spent a week and came back with a design.

CSI is playing a key role in developing closed-loop controls and intelligence in a lot of the things that we do. There’s never any substitute for human intervention in certain, big decisions you have to make. As wells deplete and water interface gets closer to the bore, somebody has to decide what to do.

Automation is absolutely important in the drilling process. As we found out with Macondo and other events, that human hand may not always be close to the valve. Things have to happen very quickly in a pre-calculated fashion to make sure safety systems are activated.

The CSI acquisition was not from your segment of the business. Is there more for industry to learn from other industries?

When the US space program downsized, we picked up a lot of people, specifically in the area of product integrity to understand how to do the reliability assessments.

We’re involved with universities all over the world that deal with different industries and disciplines, and we spend a lot of time with them to get clues as to where else we should be looking for technologies. They’ve been able to steer us toward different companies and industries where we’ve been able to pull choice tidbits of technologies to apply to us.

Our strategy is to look outside. The oil industry has been very insular over the past 15 years. We’re just starting to look around and see what everybody else is doing. We’re going to find a lot of neat stuff we’ll be able to take to the next technology level.