Dayrates are down, but rig count remains steady in Middle East

Contractors juggle dayrate cuts and NOC demands for strict adherence to performance expectations, continued recruiting and training of local talent

By Kelli Ainsworth, Editorial Coordinator

While a downward trend in activity and rig count has been observed around the world in response to the oil price slump, the Middle East appears to be bucking this trend. According to numbers from Baker Hughes, the Middle East’s rig count has averaged 404 to date in 2015. That’s nearly the same as the region’s average rig count of 406 in 2014 and up from an average of 372 rigs in 2013.

One reason may be that governments in this region are significantly dependent on oil revenues, so there is strong incentive for them to keep producing despite the fall in prices. “They are clearly still spending a lot of money when the rest of the world has slowed down,” said Stewart Williams, Vice President of EMARC Oil and Gas Research for Wood Mackenzie. Because IOCs are beholden to shareholders, while NOCs must bring in revenue for their national government, NOCs are often more motivated to keep producing even when returns are lower. “If you’re a big NOC, you rely on oil revenues, so the motivation is a bit different than for international companies.”

Like companies in other areas of the world, however, Middle Eastern NOCs are also seeking ways to reduce costs. This means contractors and service providers in the region are seeing the same lower prices reflective of the oil price drop. “They’re trying to take advantage of lower rates contractors are giving to get business,” Mr Williams said. “So even though activity’s high, when you look at expenditures, it might even be lower than what you would normally see.”

Opportunities for discovery may be somewhat limited. Although the Middle East is a mature hydrocarbon region, existing fields continue to produce at sufficient volumes that many countries haven’t seen a need for exploration in recent years. Kurdistan has been an exception, Wood Mackenzie said. This Iraqi region has seen notable discoveries in recent years. Meanwhile, there will be new opportunities for international oil companies when sanctions are lifted against Iran in 2016.

There are also opportunities for not just improvement but also innovation in downturns, according to Khamis Saadi, Petroleum Development Oman Well Engineering and Logistics Oil Director for North Oman. “Most, if not all, oil and gas industry step-changes to improve costs come during times of low oil prices,” he said. “This crisis presents itself as an opportunity.” Some of the ways companies can ensure their future success, Mr Saadi said, are attracting talent to the region from overseas, facilitating smarter alliances between companies and creating opportunities to increase local content projects. “The fact remains that oil prices will recover sooner or later and, therefore, it is better to be ready for the upturn.”

Offshore dayrates forced downward

The market’s downward pressure on dayrates have hit offshore contractors especially hard. Early this year, Saudi Aramco announced it was lowering the dayrates for all of its 48 contracted offshore rigs, including a number of high-spec rigs. According to Mr Williams, rates dropped by anywhere between 5-40%. “The contractors really couldn’t do much about it. They had to go to the negotiation table and accept what Aramco was looking for,” he said. “You have to be prepared to meet with the NOCs and accept their terms because they might be the only game in town.”

The silver lining here is that, although rates have been lowered, offshore contractors in the region do not expect contract cancellations, said Robert Eifler, General Manager of Marketing and Contracts-Eastern Hemisphere at Noble Drilling. The company has eight jackups working in the region that are contracted into 2017 and 2018. Five of these are or were recently contracted to Saudi Aramco. The other three rigs are either working or will soon go on contract in the UAE. These contracts give the company a strong backlog, Mr Eifler added. For example, the Noble Roger Lewis, built in 2007, is contracted to Saudi Aramco through March 2017, while the Noble Scott Marks, built in 2009, will be working for Aramco through July 2017.

One of the challenges Noble and other offshore contractors face in the region, even with the slowdown in activity, is NOCs’ emphasis on recruiting and training local talent. “Local content requirements have come under increased focus over the past few years,” Mr Eifler said. “In turn, all of the drilling contractors are making a big effort to hire and train local talent. That’s a focus throughout the Middle East. Noble has focused on hiring and training a local workforce since we first entered the region, and we remain committed to our efforts.”

Local content requirements can present unique recruiting challenges to offshore contractors, Mr Eifler added. As the Middle East is largely onshore focused, onshore rig jobs are often perceived by the local population to be more desirable. “Onshore is often seen as the cushier position in the Middle East right now,” he said. To change this, Noble is focused on making sure the living arrangements on its rigs are comfortable and that the company is creating clear pathways for employees to advance their careers.

Ensuring a safe working environment can also help attract talent. Three of Noble’s rigs in the Middle East have gone more than five years without a lost-time incident (LTI). The Noble David Tinsley, which began a new contract in the UAE in August, has not had an LTI in more than 10 years, Mr Eifler said.

International contractors are seeing increased competition in the Middle East from locally based contractors, however. “There’s been a trend recently over the emergence of successful local drilling contractors,” he said. “A lot of those companies are putting supply pressure on some of the international contractors such as us and our more traditional competitors.”

For example, Qatar’s Gulf Drilling International formed in 2004 and now has a fleet of 17 onshore and offshore rigs. Mr Eifler also cited the more established Arabian Drilling Company, formed in 1964, which has a fleet of 23 onshore and offshore rigs that operate primarily in Saudi Arabia. Although demand in the Middle East has been robust enough to keep all contractors working at the moment, Mr Eifler said, “I think some of the local contractors will be an interesting story to watch over the next few years.”

Engineering efficiency

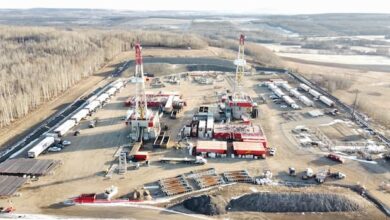

Onshore drilling contractors in the Middle East have continued to see steady rig demand, said Manoj Raghavan, KCA Deutag Senior Vice President. As of early October, the contractor had 15 rigs in the Middle East – one in the UAE, 10 in Oman, two in Iraq and two in Kurdistan. Four of these rigs were newbuilds delivered to the region in 2015, and two more will be delivered to Oman before the end of the year.

Most of KCA Deutag’s newbuild rigs are 2,000-hp Bentec E-450-AC rigs, capable of drilling to 23,000 ft. “The standard of rigs that are required in this market has drastically matured over the years,” Mr Raghavan said. “We are now at a level where some of the best technologies are deployed here.” The company’s rigs in the region feature AC technology combined with slingshot substructure, 1 million-lb hookloads and 1,600-hp mud pumps.

Recent rig design has focused on meeting operators’ demands for rigs that are designed with safety hazards engineered out, that have minimized dropped object potential, can be moved between sites quickly, drill more effectively and reduce flat time. The company’s most recent newbuilds have been designed so that they can be moved in larger pieces and reassembled quickly and easily when they reach their new location. “Some of our rig moves have been reduced from 10 to 12 days down to four to six days,” Mr Raghavan said. KCA Deutag is working on completing the move for the SPEED basic rig package – excluding the camp – in just 36 hours, he added.

Operators are also asking for increased automation. “Automation features are now fairly standard in most of the equipment we have in the Middle East,” Mr Raghavan said. The company’s most recent newbuilds come equipped with iron roughnecks, power slips and hydraulic catwalks. While the company’s new rig in Europe has been outfitted with automated pipe-handling devices, this technology has so far not been implemented on the company’s Middle Eastern rigs yet, although Mr Raghavan sees this changing in the near future. “We are looking at how we can utilize this in the Middle Eastern market and adapting it to make sure we get the same level of efficiency here, as well.”

One of the primary benefits of building more automated rigs, he added, is that they’re safer. “We are trying to improve safety and eliminate the risk to people working in hazardous areas, especially drop zones,” Mr Raghavan said. “Engineering out the hazards has been one of the key factors incorporated into the design.”

Training crews to work on these increasingly high-technology rigs has also been an area of major focus. Crews are familiarized with the new rig equipment initially in a classroom setting before moving on to KCA Deutag’s DART training module. Real-time simulation provides trainees with virtual exposure to the rig’s systems and equipment. Finally, the crew gets hands-on training on the rig under close supervision. “You can see the benefits from the level of training we provide when we start operations. It’s trouble-free and much smoother for our clients with a lower incidence rate and lower flat times,” he said. “It is time and money well spent.”

Proceeding with caution

While the uptake of new technologies can help address concerns around safety and efficiency, other concerns in the region are more complicated. In August 2014, as ISIL troops approached the Kurdistan border, a number of companies working in the region pulled their personnel out of the area. “By February or March of this year, all companies were back operating in Kurdistan,” Jessica Brewer, Middle East Upstream Analyst for Wood Mackenzie, said. “All companies in Kurdistan feel they can mitigate that risk enough.”

One of the drilling contractors working to manage these risks is Sakson. The Dubai-based company moved into Kurdistan in 2008 after seeing growing operator interest in the area. Four of the company’s rigs were operating in the Kurdistan region of Northern Iraq until 2014, and it now has one rig there. “To meet the challenges and to overcome the logistical issues of a first mover, the company relied on the expertise of its staff, of which the majority has 15 to 20 years industry experience, in combination with close collaboration with the client and the local governments,” Eric Houlleberghs, Sakson VP of Corporate Affairs, pointed out.

“With ISIL sitting about 50 km from where we have a rig standing, the situation is infinitely more complex than in the early days,” Mr Houlleberghs admitted. However, through continuous risk assessment involving contractors active in the region, intelligence gathering and interaction with Kurdish government entities, he said he is confident that a safe work environment can be offered to the people on the ground. “Using the intelligence gathered, we continuously do our own risk analysis and risk assessment, allowing us to constantly update our mitigation plans, including our emergency response plans.”

Kurdistan has been a prolific area in the Middle East for exploration and new discoveries, Ms Brewer said, “although it does look at the moment like the number of exploration wells is going to be reduced.” Many smaller companies with leases in the area will likely turn to developing discovered assets rather than exploration in light of low oil prices. However, some of the major IOCs are still exploring Kurdistan, including TOTAL and ExxonMobil.

These exploration efforts have yielded discoveries. In December 2014, Marathon Oil made a discovery with the Jisik-1 exploration well, in the Harir block in northern Kurdistan. The well, drilled to a total depth of 15,000 ft, encountered oil and gas in the Jurassic and Triassic reservoirs. Tests demonstrated a sustained flow rate of 6,100 BPD of oil, and non-associated gas zones flowed at a combined rate of approximately 10-15 million cu ft/ day, the company said in a press release.

Sakson’s rigs have been utilized by Oil Search Iraq and partner TOTAL to drill exploration wells in the Taza block. Oil Search had determined that the Taza-1 well, drilled in 2012, contained a pre-drill potential resource estimate of 250-500 million bbl of recoverable oil. However, subsequent appraisal wells drilled in 2014 and 2015 have been less promising, though Oil Search is planning at least two future appraisal wells in the block.

A key element that has allowed Sakson to address the challenges in working in remote areas such as Kurdistan, Mr Houlleberghs said, is the company’s decision to work with just two rig manufacturers. This allows the company to reduce the response time in case of equipment failure. Standardization and the resulting time savings are particularly important in a downturn. “Companies that we are drilling for are pushing hard for strict compliance to the contract. There is enormous focus on performance, and key performance indicators are constantly measured,” Mr Houlleberghs said.

This is a good thing for the industry, he said. Overall, low oil prices could result in making the industry stronger, as competition will increase and contractors that have the best technologies, processes and performance will come out on top. “In my view, the $100 oil price made the industry lazy. The industry was falling asleep,” he said. “People were making enough money to allow mistakes. Now that’s definitely gone.”

Opportunities in Iran

Beyond Kurdistan, new opportunities for the industry can be found in Iran, where economic sanctions may be lifted by next year. “Iran is seen as one of the really good opportunities for both oil and gas production and later, exploration,” Mr Williams of Wood Mackenzie said. In particular, he sees significant potential for international drilling contractors as Iranian oil companies seek to increase production.

As for international operators, exactly how much investment they will put into Iran will depend heavily on the fiscal terms that are offered. In the 1990s, before some of the sanctions were in place, Iran offered foreign oil companies buyback contracts to redevelop producing fields. They “really didn’t work out too well for the IOC investors,” Mr Williams said. He believes that this time around, Iran will need to give more consideration to costs and oil price linkage in order to allow foreign companies to take on risk, as well as the upside if oil prices go up.

If Iran adopts terms similar to what Iraq offered foreign oil companies back in 2010, international operators may be hesitant to pour CAPEX into Iran at this time, Mr Williams continued. Many companies ultimately struggled to make much profit in Iraq, so the industry at large will be looking for terms that are at least slightly better to proceed in Iran. “They will have to be a bit better because some of the companies will look at the troubles they’ve had in Iraq and think they have to make sure they get some value out of these contracts.”

Regardless of the fiscal terms offered, said Jim Krane, Wallace S. Wilson Research Fellow at the Baker Institute for Public Policy at Rice University, US-based companies are unlikely to partake in new opportunities. “I don’t think that US companies are going to be flocking to Iran anytime soon,” he said. “Most of the business will go to non-US companies, such as the big IOCs in Europe.”

Enhancing recovery

In Oman, which is dominated by large fields that have been on-stream for decades, enhanced oil recovery (EOR) technologies are starting to play bigger roles. The EIA credits EOR with the turnaround in Oman’s oil production, which peaked at 970,000 BPD in 2000 and had declined to 710,000 by 2007. After implementing EOR in 2010, production surpassed 900,000 BPD in 2012. “The other Middle Eastern countries are probably looking at Oman as an example of what you can do,” Mr Williams said.

A sizeable portion of the annual production from PDO now comes from EOR projects, according to Mr Saadi. PDO, which accounts for approximately 70% of the oil production and nearly all of the natural gas production in Oman, began its first EOR project in 2010 on the Marmul field, originally discovered in 1956. To recover more oil, PDO added a polymer to water as a thickening agent and injected the water into the field to sweep oil into producing wells.

In addition to polymer injection, PDO has utilized miscible gas injection, which involves injecting a gas into the reservoir into which oil can dissolve, allowing the oil to move through the rocks more easily. Thermal recovery techniques, including steam flood and cyclic steam injection, have also boosted production from PDO’s older wells.

PDO anticipates that EOR will account for a third of its annual production by 2023. The company’s drilling program remains intact for 2016, Mr Saadi said, consisting of approximately 80 drilling and workover rigs and more than 70 well intervention units. Additional details were not available as the company is still finalizing its program for board approval. DC

SPEED and DART are registered terms of KCA Deutag.