Oil & Gas Markets

Wood Mackenzie: Continued consolidation, caution around upstream spending among key trends in 2024

Key themes to watch for in global and corporate upstream this year, according to a new report from Wood Mackenzie, include continued consolidation, increased activity from national oil companies (NOCs), reversing decarbonization gains, shifts in strategic playbooks and an upstream investment plateau.

Consolidation: Higher market valuation multiples, easier access to finance for larger companies, lower costs and better execution are some of the incentives. “For deals to work, they need to demonstrate improved operational, financial and, for some deals, emissions performance,” said Fraser McKay, Head of Upstream Analysis for Wood Mackenzie.

NOCs: COP28 has placed greater emphasis on sustainability plans. The effect for some NOCs will be bigger ambitions in low carbon and emissions abatement. However, upstream growth will still be on the agenda for most NOCs.

The Middle East will lead much of the growth, with ADNOC, Saudi Aramco and Kuwait Petroleum Corp increasing their spend to meet domestic capacity targets.

They may also target more mergers and acquisitions. “The NOCs have reset financial strength and will target M&As to plug strategic gaps in gas, LNG, short-cycle oil and international exploration,” said Neivan Boroujerdi, Director, Corporate Research and NOC Lead.

Decarbonization: Wood Mackenize forecasts production will rise by 3% in 2024, and decarbonization won’t keep up. Upstream scope 1 and 2 emissions will increase by 12 million tonnes of CO2e year-on-year.

Shifts in strategic playbooks: There will also be continued adjustments to the strategies of oil and gas companies, driven by sustainability concerns, stakeholder pressures and low valuation multiples. “Investors want a reliable, growing base dividend as a reward for rising energy transition risks,” said Tom Ellacott, Senior Vice President of Corporate Research. “But companies will have to grow cash flow if they want to grow dividends, rebalancing capital allocation toward investment to maintain sustainable cash-generating businesses.”

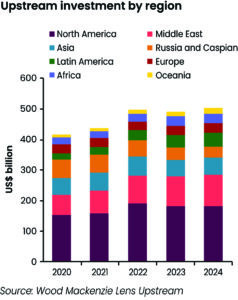

Upstream investments: Operators will remain focused on resilience, sustainability and efficiency. Most will exercise caution in the face of inflation, bottlenecks and price uncertainty, with confidence undermined by widening OPEC+ production cuts. Global spend in 2024 will reach just over $500 billion, up just 2% from 2023 after a rise of 18% over the past three years, all in real terms.

“Investment will rise in the Middle East but fall in the US Lower 48,” said Ian Thom, Director of Upstream Research. “The new project pipeline remains healthy, with 45 projects vying to take final investment decision – a potential investment commitment of $170 billion to develop 25.5 billion BOE. Around 30 will proceed in 2024. Many of these will be deepwater discoveries, with the 10 biggest deepwater oil projects requiring $52 billion of investment for recoverable resources of 5 billion barrels of oil.”

Global economic weakness or a loss of unity in OPEC+ are key investment wildcards.

Westwood forecasts positive outlook for global land rig demand through 2027

The global land drilling rig market is continuing to recover from the lows seen in 2020 and 2021, with demand for rigs totaling an estimated 4,559 in 2023, according to Westwood Global Energy Group’s December rig market forecast. That is a 4% increase compared with 2022 and 32% compared with the low point of 2020.

Westwood also forecast that global land drilling rig demand will average 4,718 units between 2023 and 2027.

On a regional level, China is forecast to lead the demand, accounting for 28% of the global total. The country will continue to drill deeper wells in shale gas plays and increase activity on mature fields as part of efforts to increase domestic production.

In the Middle East and North Africa, demand from the Gulf Cooperation Council (GCC) countries is forecast to grow by almost 50%. In Latin America, meanwhile, many countries are expected to see declines. Argentina will be the exception there, with development of the Vaca Muerta Shale Basin continuing to support increased demand.

In the US, the outlook is relatively flat, as operators continue to prioritize capital discipline.

In Russia, the outlook remains negative due to the impact of Western sanctions stemming from the Ukraine conflict.

While the overall market outlook is generally positive, utilization is still a relatively weak 52%, reflecting the continued oversupply in the market. The global capable land rig fleet was estimated to be approximately 9,000 as of November.

However, demand for high-horsepower rigs (2,000-hp or more), which account for less than 1,400 of the total capable rig fleet, is expected to be strong in regions like China and the GCC countries. Westwood believes there is potential for these regions to be undersupplied with high-spec rigs in the later years of the forecast.

And it won’t just be in those regional hotspots where high-spec rigs will be in high demand, as operators will continue to drill more complex wells while aiming to maximize value from each well. This will mean more positive outlooks for contractors with high-spec rigs in their fleets.