Exploration boom in Guyana-Suriname: high dollar, high stakes

Giant-sized discoveries and low breakevens continue to fan enthusiasm for this South American basin despite recent disappointments

By Stephen Whitfield, Associate Editor

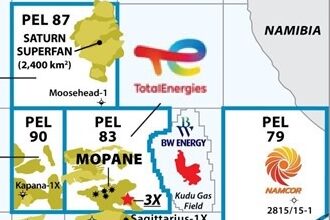

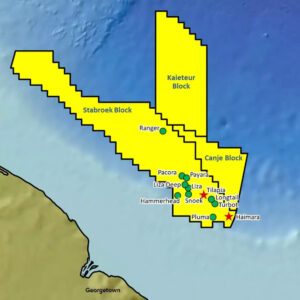

Just offshore the countries of Guyana and Suriname is a basin that has become the focal point of a major South American oil boom. With ExxonMobil making 18 discoveries in the Stabroek Block offshore Guyana since 2015 and Total making four discoveries at Block 58 offshore Suriname since January 2020, the area continues to generate significant attention from all stakeholders. For offshore drilling contractors specifically, anticipation is high that this emerging region could help to boost both near-term and long-term rig demand.

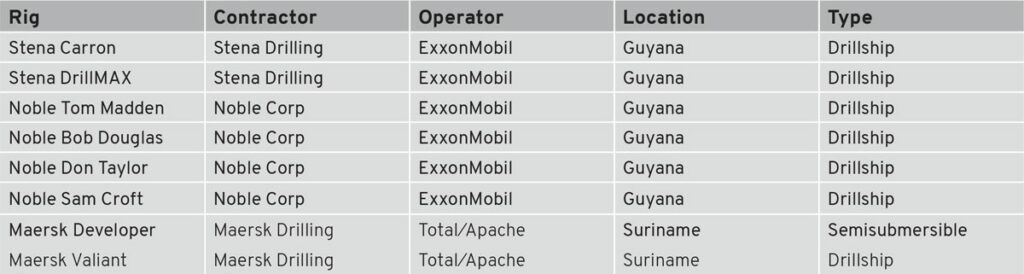

The Guyana-Suriname Basin currently has eight active rigs, up from five in 2020. ExxonMobil, the only operator with rigs in Guyana right now, boosted its fleet of contracted drillships to six in April, with the arrival of Noble Corp’s Noble Sam Croft.

According to Rystad Energy, three drillships are currently performing development drilling operations in the greater Liza area in the Stabroek Block. The recently arrived Stena DrillMAX from Stena Drilling initiated drilling activities on the Longtail-2 appraisal well, while the Stena Carron drillship spudded the Jabillo-1 exploration well in the Canje Block.

The Stena Forth drillship left the basin in March after drilling the Goliathberg-Voltzberg North-1 (GVN-1) well in Block 47 offshore Suriname. However, a ninth rig appears set to enter Guyana this year. In late April, CGX Energy announced a contract with Maersk Drilling for the Maersk Discoverer semisubmersible, which will perform exploration work on the Kawa-1 well on the Corentyne Block starting in Q3 2021.

Suriname, where field development has yet to begin, has two of the basin’s eight active rigs. The Maersk Developer semisubmersible and the Maersk Valiant drillship began exploration and appraisal work on Block 58 in January and March 2021, respectively, for a joint venture between Apache and Total. Production from this block is not expected before 2025, according to Total, which took over as operator this year.

“If we compare the timeline in Suriname to what happened offshore Guyana, we’re looking at almost five years from discovery to first production,” said Jamie Collard, Senior Analyst at Westwood Global Energy. “It could be slightly faster now that it’s a more established basin, but it will be a few years until there’s any development drilling in Suriname.”

Westwood estimates that the number of exploration and appraisal wells drilled in the basin this year will be in the low to mid-20s, compared with only nine in 2020. ExxonMobil, the operator of the Stabroek Block, has highlighted 10 exploration and appraisal wells in Stabroek in 2021, and Total has said it will participate in up to nine wells in Suriname-Guyana this year.

Floater dayrates in the basin are currently approximately $200,000, said Terry Childs, Head of RigLogix at Westwood, citing published data for the Maersk Valiant and Maersk Developer.

Mr Childs believes the rig count could increase in 2022, although only by one or two at most. There are currently seven rig tenders from operators in the basin – four in Suriname and three in Guyana. Tender activity is also likely to increase in Suriname on the heels of its shallow-water licensing round, which ended on 30 April. However, drilling likely will not begin until late 2022 or 2023, he added.

“Right now, you have all long-term rig contracts in Guyana, but in Suriname, a lot of the contracts are for just one or two wells where, in many instances, the rigs leave right after,” Mr Childs said. “Total is starting to award some longer-term contracts but, by and large, it’s still a lot of exploration drilling, so it will mostly remain one- or two-well deals in Suriname.”

Pushing the boundaries

While most of this year’s planned activities are in Stabroek and Block 58, there is momentum building in other blocks, all offshore Guyana. In addition to Kawa-1 on the Corentyne Block, CGX Energy is planning another exploration well on the Demerara Block. ExxonMobil also plans to drill two wells on the Canje Block, in addition to the uncommercial Bulletwood-1 well announced in March. Also this year, 3D-seismic reprocessing is scheduled for the Repsol-operated Kanuku Block and Tullow Oil’s Orinduik Block, with the hopes of maturing prospects for future drilling. There are no drilling plans as of yet, however.

Results from these efforts will likely determine drilling activity levels outside of Stabroek and Block 58 over the next couple of years, Mr Collard said. If an operator confirms a significant discovery in one of these less developed blocks, it will likely encourage additional exploration. Whether Guyana proceeds with a new bidding round in 2022 will be another key factor.

However, even if the environment is favorable for further exploration, it’s not likely to happen until later in 2022 or into 2023. “Success so far has been focused on the so-called golden lane, which is a northwest/southeast-trending line of discoveries. At the moment, the only commercial discoveries have been in Stabroek and in Block 58,” Mr Collard said. “Elsewhere, we can’t be sure that there will be any development or even appraisal. We’ve seen how difficult it’s been, looking at ExxonMobil’s results at Tanager and Bulletwood and Tullow’s at Joe and Jethro. Any additional development outside of the two licenses could take quite a few years.”

ExxonMobil saw three failures in a four-month span, with the most recent coming in Bulletwood-1 in March, a well targeting more than 500 million bbl of mean prospective resources, on the Canje Block.

These disappointments are not expected to tame overall enthusiasm for the region, however. “In the past five years, the commercial success rate for high-impact exploration wells globally has been about 25%,” Mr Collard said. “When you look at Stabroek delivering a commercial success rate of 85% to 90%, it just shows how amazing the block has been. Companies have been trying to extend the play over the past year, and it’s not surprising that there have been some recent failures.”

Carole Nakhle, Founder and CEO of Crystol Energy, a London-based consultancy and advisory firm, said she believes operators will be patient in exploring new areas in the basin. “Of course, companies are going to concentrate their efforts on the most promising prospects, but this doesn’t mean that they avoid other less explored areas, especially as their understanding of the geology improves and the infrastructure develops to allow for easier exploitation of remote prospects,” she said.

Shell is expected to drill an exploration well in Block 42 offshore Suriname next year. Kosmos Energy had sold the block after failing to discover hydrocarbons at the Pontoenoe-1 well in 2018. Block 42 would be Shell’s first foray into Suriname – it had previously planned to partner with ExxonMobil on the Stabroek Block but pulled out of the partnership before any wells were drilled. Petronas, which announced its first discovery in Suriname last December with the Sloanea-1 exploration well, may also drill a follow-up campaign, according to Bassoe Offshore. Sloanea-1 was located in Block 52 – where Petronas shares 50/50 interest with ExxonMobil – and was drilled with the Maersk Developer.

The basin as a growth driver

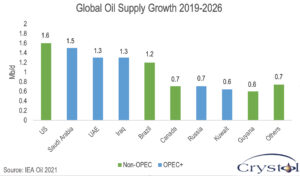

By 2026, the International Energy Agency (IEA) estimates Guyana will be producing 600,000 bbl/day of oil, which would rank it fifth among non-OPEC countries and ninth overall. In fact, the agency expects the country to be among the top-10 largest contributors to global supply growth. Rystad Energy projects Guyanese government income from oil production will grow from $270 million in 2020 to $10 billion by 2030.

None of that growth would be possible without operators’ willingness to pour money into the basin. Hess is devoting more than $780 million for its offshore Guyana developments this year, making up 41% of its planned 2021 CAPEX. Apache said in February that most of its $200 million exploration budget for 2021 would go to its operations in Suriname. These commitments and others come at a time when every E&P company is prioritizing capital discipline, an indication of the continued attractiveness of this region.

Part of the appeal is the sheer volume of the discoveries – ExxonMobil estimates more than 9 billion BOE in recoverable resources at the Stabroek Block, while Total estimates up to 6.5 billion BOE in Block 58. Reportedly low breakeven prices have been another draw. Hess, ExxonMobil’s partner in Stabroek, reported a Brent $35/bbl breakeven price for the Liza Phase 1 development, $25/bbl for Liza Phase 2 and $32/bbl for the Payara development.

“At these breakeven prices, Guyana and Suriname provide unique, long-term opportunities for operators and drilling contractors,” said Carlos Ortiz Reguer, Chairman of the IADC Latin America Chapter. “When you look at those numbers, those projects are some of the most competitive projects worldwide. There are a number of efficiencies and economies of scale that can be achieved when we get multiple rig lines that extend over a relatively long period of time.”

While the basin is doubtlessly an attractive investment option, Dr Nakhle cautioned that cost inflation could be a near-term challenge, especially as governments seek ways to alleviate the burden of the pandemic on their finances. Since March, the Brent oil price has traded comfortably between $60-65/bbl, but Dr Nakhle believes there is potential for the price to increase faster than expected, especially if COVID-19 vaccination rollouts accelerate around the world. “If prices increase rapidly, they will attract the taxman, and this in turn can counterbalance any gains achieved from low oil price and low breakevens,” she said.

Ernst & Young forecast 1.6% inflation for Guyana in 2021, up from the 0.9% inflation seen in 2020. The Guyanese government has said it has no plans this year to revise its petroleum sharing agreement (PSA) or consider new tax measures for the oil and gas sector. However, Ashni Singh, the country’s Minister of Finance, said in February that the government is exploring a revised petroleum fiscal regime, which could mean changes to royalties as outlined in previous PSAs.

Building a local industry

As Guyana and Suriname are both still emerging areas for oil and gas production, questions around local content seem inevitable. While it’s still unclear when Suriname might pass any official local content policy, the situation is much different in Guyana, where E&P projects are more mature.

The country first began discussing a local content policy shortly after ExxonMobil’s Liza discovery in 2015. The policy has seen several rounds of consultations by two different administrations in the six years since.

An earlier version of the policy, released in February 2020 under former President David Granger, was scrapped by current President Irfaan Ali in August 2020 because of a lack of incentives for local participation in the oil and gas sector.

During last year’s presidential campaign, Dr Ali pledged stricter local content rules, with an emphasis on training more Guyanese citizens to take up specialized positions. He formed an advisory panel to create a new policy in August, and a draft version was released in February 2021.

This new draft set, among others, a 95% local content requirement for the fabrication of drilling modules or packages, well completion services, well stimulation services, cutting injection and disposal services, and crisis management. The requirement would have to be met within 10 years of the policy’s adoption. It also includes a 90% requirement for directional surveying services, an 85% requirement for LWD services and an 80% requirement for wireline services, all in the same 10-year timeframe.

While Mr Ortiz Reguer acknowledged it would be challenging to establish such high levels of local content, he believes an aggressive approach could be positive for Guyana.

“I believe the local entrepreneurs, government authorities and regulators are taking strong steps toward actually building a local oil and gas industry in Guyana,” he said. “We’re seeing significant progress in infrastructure construction and, very importantly, in multiple training programs for the local workforce that are being put in place. Guyana is taking firm, well-thought steps toward this development despite the fast pace at which they became a relevant player.”

The Guyanese government held public consultations in March on the draft policy, meeting with more than 180 public and private sector agencies and firms that are either directly or indirectly involved with oil and gas production in the country. Once the policy is finalized – no date has been set for this – it will be brought up for consideration by the National Assembly.

ExxonMobil has criticized the newer drafts of the policy, asserting the local content targets are unrealistic and could have negative impacts on operations in the country. “Local content policy or legislation should be informed and supported by appropriate economic, labor and industrial baselines,” ExxonMobil Guyana President Alistair Routledge said in a statement released on 3 April. “It is essential that when driving local content in one sector, actual and projected national capacity is taken into consideration to avoid negatively impacting other sectors.”

There are already efforts ongoing within the industry to bolster local content in Guyana. In February, a consortium of operators – including ExxonMobil, Hess and CNOOC – announced the details of the Greater Guyana Initiative. The companies pledged to spend more than $100 million to significantly expand its efforts to build local content capacity. The initiative would be jointly set up with the Technical and Vocational Education and Training Unit, a part of Guyana’s Ministry of Education; the University of Guyana; and the Center for Local Business Development, created in 2017 by the operator consortium in partnership with the Guyanese government.

IADC is also supporting the development of an E&P industry in Guyana, most notably through the Latin America Chapter established last year. Currently, the chapter is focused on identifying ways to create value for drilling contractors and affiliate companies in the area, Mr Ortiz Reguer said. Its upcoming bi-monthly meeting, on 27 May, will provide a forum for members to gather and discuss local content requirements and other local concerns.

“The vision of the chapter is to be the reliable voice of the drilling contractors and affiliate companies in this area,” he explained “We are working to engage with other relevant stakeholders to promote best practices, to find out what the issues are for the membership, and identify the stakeholders within the regulatory bodies to address those issues.” DC

Click here to learn more about the IADC Latin America chapter.