The rising East

Demand growing for high-spec jackups, more deepwater rigs across energy-hungry Asia Pacific

By Astrid Wynne, contributing editor

The widely varied Asia Pacific energy market is on the cusp of significant change. From the export market of Australia in the south to the energy-hungry nations of Indonesia, Malaysia, Thailand, China and Japan, countries are looking to maximize domestic production. The outlook for drillers is good but growing increasingly challenging technically. With deeper and more complex wells, planned deepwater expansion, the ripple effect of the North American shale revolution and the advent of methane hydrates, the Asian drilling landscape is changing fast.

In this article, PTTEP, SapuraKencana Drilling, Japan Drilling Co, KS Drilling, Far East Energy and industry analyst Douglas-Westwood provide current perspectives on regional drilling issues.

Market overview

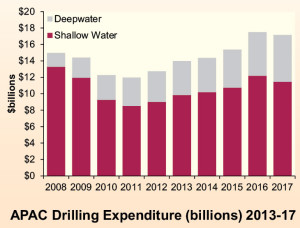

Thom Payne, Douglas-Westwood associate director in Singapore, estimates US$162 billion will be spent on offshore E&P in Asia Pacific over the next five years at a compound annual growth rate of 4%. Drilling spend will take up approximately 45% of that total, while Australia will account for approximately 27% of the drilling dollars, Indonesia 19% and Malaysia 11%. Of the offshore wells to be drilled in Asia Pacific between 2013 and 2017, it’s expected that 30% will be in China, 25% in Thailand and 15% in Indonesia.

Investment in the export-based Australian gas market is mainly expected from large IOCs like Chevron, but other players, such as Apache and BHP Billiton Petroleum, also are making significant investments. According to Mr Payne, most foreign companies in the offshore Malaysian market go through Petronas, which is translating to a robust jackup market on the back of Petronas’ EOR plan to maximize existing reserves.

There are also several deeper-water prospects, notably involving Murphy Oil’s Kikeh Spar project in water depths of approximately 1,300 meters (4,265 ft) offshore Labuan and Shell’s Gumusut-Kakap at up to 1,200-meters (3,937-ft) offshore Sabah.

According to Douglas-Westwood data for September, there were 125 active jackups in Asia Pacific, with an 89% utilization. In addition, there were 32 active semis, 11 active drillships and 19 active tender rigs, with utilization rates of 78%, 65% and 70%, respectively. In Southeast Asia, in particular, rig count has been increasing over the past year, Mr Payne said. Jackup count for the area was 65 in September, compared with approximately 55 a year ago. Southeast Asia dayrates for jackups also are undergoing an upward trend, thanks to a growing demand for high-specification units; rates have averaged $130,000 for the year.

For semis, dayrates are currently running 25% lower than the rest of the world because there is not as much deepwater activity here, he explained. However, this is also changing, and the number of wells in water depths greater than 500 meters (1,640 ft) is expected to increase by 20% over the next five years.

The local tender market

Raphael Siri, senior vice president of Malaysian SapuraKencana Drilling (SKD), sees a trend in Southeast Asia that is similar to one seen around the world: The days of easy drilling are over. “It is a mixture of re-entry wells and development projects. We are drilling into more challenging formations with more fractures, a variance of HPHT and low pressure and more deviation to reach all the carbon pockets. This means there are fewer easy returns and more risk of lower carbon productivity. However, rigs are now running more efficiently and more safely with fewer incidents, so the overall pace of drilling has increased over recent years,” he said.

Offshore Thailand, he added, concurrent single and offline activity coupled with relatively straightforward geology and well designs mean that some wells can be drilled in just five to eight days. These wells range from 9,000 to 15,000 ft (2,743 to 4,572 meters) deep. “Another example would be Indonesia, where we are doing up to 10,000 ft, completed within 15 days,” Mr Siri said.

SKD acquired Seadrill’s tender rig division in May 2013. It now has the largest tender fleet by rig count, owning just over half of all tender rigs globally. In Southeast Asia, the company manages 17 tenders and semi-tenders, including two that are still owned by Seadrill. One is currently ready to work, and another will be transferred internally to strengthen the SapuraKencana Petroleum Berhad Construction division. The rest are drilling in Thailand, Malaysia, Indonesia, Myanmar and Brunei for Shell, Murphy Oil, Chevron, Petronas Carigali, ConocoPhillips and Carigali-PTTEP, a joint venture between subsidiaries of Petronas Carigali and PTTEP.

SKD also has three newbuilds under construction. The SKD T-18 tender in China’s COSCO yard is due for delivery in Q1 2014, and the SKD T-20 tender is due out of the Kencana HL yard in Lumut, West Malaysia, in Q2 2014. The third rig, the SKD Kinabalu semi-tender, is also under construction at the Lumut yard.

Mr Siri said that SKD’s rig utilization is running at nearly 100%, even with new contract lengths shrinking in Southeast Asia. “A five-year contract for newer rigs was common three years ago. Now it is closer to two years with still a few five-years. There are a few reasons for the programs getting substantially shorter. The easy oil is gone,” he said. “A lot of the current programs are focused on enhanced oil recovery or workover and well improvement. These programs are shorter because they are often on live platforms where production cannot be interrupted. In addition, operators are lacking the human resources to project-manage long programs, and the equipment lead times for well equipment are becoming extreme, now measured in years rather than months.”

On the other hand, he does see rig rates rising steadily, although still 15% to 25% lower than offshore West Africa. SKD has the West Setia working offshore Angola for Chevron and the West Jaya offshore Trinidad and Tobago for BP. The latest delivered newbuild, the West Esperanza semi-tender, recently began a contract with new client Hess in Equatorial Guinea.

“Today our pace is in Asia, but tomorrow the prospects are increasingly outside Asia. That doesn’t mean we’re not going to grow Asia, but, at the same time, it’s a mature market where we are going to grow organically. Outside of Asia, the potential to grow is exponential,” Mr Siri said.

Closer to home, the company sees opportunities in Myanmar, where the SKD T-9 is drilling for PTTEP. “The Myanmar tender market has huge potential, but it has additional challenges. The currents and overall weather is more demanding. It’s also a new market, so infrastructure and support functions are still being developed. You can only grow as fast as a country can cope with or can allow you to,” Mr Siri said.

Thailand

PTTEP drills more than 140 wells a year in the Gulf of Thailand and more than 100 wells per year onshore Thailand. Most are development wells, but the number of exploration and appraisal wells has been increasing as PTTEP strives to maintain production plateau on major domestic projects, such as the S1 onshore block and Bongkot and Arthit in the Gulf of Thailand.

The Thai NOC currently has four jackups and one tender contracted offshore Thailand from COSL, Ensco, Vantage Drilling, Seadrill and SKD. Floaters are not needed offshore Thailand, where plays lie in shallow water. However, the wells are increasingly deep, which presents its own problems. “The Gulf of Thailand is a well-known area where the geothermal gradient is abnormal. We are talking about 5.8-6°C per hundred meters compared to 3-4°C elsewhere,” said Kanit Sangwongwanich, senior vice president of the Well Technology, Operations Supply Chain & Technology Group at PTTEP.

“In the Gulf of Thailand, we are looking at 3,500 meters in terms of vertical depth, and the temperature bottomhole can reach above 175°C, some even above 200°C. We would like to go beyond that and have been working closely with our vendors on their R&D.” Efforts have encompassed electronic components and cooling systems that can withstand the higher temperatures. “Once these tools fail, we need to pull the drill strings out of the hole, and that is very costly,” Mr Sangwongwanich said.

PTTEP is also looking to fracturing technology that could provide increased recovery from low-permeability reservoirs, which are found in deeper sections of the wells onshore and offshore Thailand. “Since we are going deeper, we are also encountering higher downhole pressure. We need to cope with increasing bottomhole pressure up to 15,000 psi. The sandstone reservoirs we are now encountering seem to be getting tighter in terms of rock property. We are looking at low permeability in the reservoirs so we need to look at production technology to try and solve these tight reservoir problems.

“We started experimenting with fracking technology a few years ago just to get a feel for it, and we intend to be more focused now on fracturing because we believe that the technology can provide us with the tool to reach some of the reserves that we currently classify as non-producible. It’s a matter of the right application to our Gulf of Thailand or Thailand environment.”

PTTEP also has significant international interests, including assets in the Middle East, North Africa, East Africa, Australasia and North America. It operates exploration concessions in Cambodia and Indonesia and is joint operator on two production concessions offshore Vietnam. It also has a significant operating presence in Myanmar, among the newer markets in Asia Pacific.

Myanmar

Until relatively recently, Myanmar was a closed market with a limited foreign presence, among them PTTEP. The Thai NOC has had long-term partnerships with Total on the Yadana offshore concession and with Petronas on the Yetagun concession. With the increasing number of concessions now available, PTTEP has added four new operated fields to its portfolio. Mr Sangwongwanich said his company has some blocks in approximately 20 meters (66 ft) of water and some in 120-150 meters (394-492 ft). “We also have a very deepwater block, more than a kilometer (3,280 ft). These different environments pose different challenges for our team there.”

PTTEP has one onshore and three offshore operated concessions in Myanmar. The onshore exploration contract in the Central Myanmar Basin is still undergoing 2D seismic testing, which will continue until Q3 2014.

The offshore exploration concessions are the Myanmar M3 and Myanmar M11 projects in the Gulf of Martaban. The Zawtika offshore development project will require two additional appraisal wells in Q4 2013. Drilling is in progress with two tenders, KCA Deutag’s Glen Affric and the SKD T9.

Major challenges offshore Myanmar include cyclones during monsoon season, as well as greater water depths compared with Thailand. Infrastructure in this relatively new market is also a challenge, particularly on land, but Mr Sangwongwanich said this could actually be a growth platform for the future.

Indonesia

Indonesia has many high-value fields and large blocks that are attractive to oil companies, and Chevron’s high-profile $7 billion Gendalo-Gehem project could open the door to more drilling. Gendalo-Gehem is a deepwater gas project Chevron announced in December 2010. It is located in Kutai Basin in the Makassar Strait, offshore Kalimantan. Total and Eni also are operating in the Kutai Basin, along with smaller independents such as Salamander Energy and Kris Energy.

Mr Payne of Douglas-Westwood explained that, as the large subsea fields get developed offshore Indonesia, it will also bring along activity to the more marginal fields because the infrastructure will already be in place.

“If (Gendalo-Gehem) goes smoothly, I would expect a lot more expenditure there over the next three to seven years,” he said. “It’s been on the tender table for a long time and has gone through a number of delays. But from what we understand, a decision should be made on that soon, so that will be a major subsea development that will change the landscape there.”

With more mature fields and development drilling, Indonesian NOC Pertamina is taking over many of the shallow-water fields that are expiring and intends to invest significantly to enhance production, Dr Paul Brunet, deputy chairman of Singaporean KS Drilling Group, said. “They are enhancing production and looking for new reservoirs at different depths. The main focus for new oil will be to drill deeper. In Indonesia, so far they haven’t really explored too much the deep potential, so I think that will slowly increase as time goes on.”

In the near term, Dr Brunet sees a requirement for 30 additional land rigs on top of the 100 operating onshore and a total of 20 to 25 jackups, up from the 13 currently offshore.

KS Drilling has two jackups at the moment and three more under construction. The KS Java Star is drilling for Pertamina on the West Madura field in Indonesia, and the KS MedStar is drilling for Petrobel offshore Egypt. The Java Star 2 is due to be delivered by the ZPMC yard in China in the first half of 2014. The intention is to drill for Pertamina offshore Indonesia in partnership with Pertamina Drilling, a subsidiary of Pertamina.

Two other newbuilds – the Orient Star 1 and Orient Star 2 – are under construction by COSCO in China and are slated for deliveries in the first half of 2014. Both are LeTourneau 240-C Class jackups, suitable for harsh environments.

On land, KS Drilling owns the Discoverer 8, a fast-moving “skidding rig” manufactured by Indonesian Citra Tubindo Engineering according to KS Drilling’s concept design. The Discoverer 8 works alongside the Discoverer 9, owned by Pertamina Drilling, on the ExxonMobil-operated Cepu field in Java. KS Drilling manages them in partnership with Pertamina Drilling.

“For this particular operation, the skidding rigs drill 16 wells on the same pad without being rigged down at all. With all their drill pipe and completely rigged up, they can walk from one well to the next so they will probably be on location one and half years before being rigged down,” Dr Brunet said. They are designed to be fast moving; the main body of the rig, including the mast and substructure, can be transported in seven loads, including the top drive. It can also be raised independently of the rig’s main power system, he added.

The manufacture of Indonesian rigs is a step forward for local industry as Kris Teanar Wiluan, chairman and chief executive of KS Drilling’s parent company KS Energy, explained. “The local manufacture of the state-of-the-art skidding drilling rigs in Batam Indonesia showcases Citra Tubindo’s manufacturing capabilities to fabricate drilling rigs that meet the high specifications of ExxonMobil. This meets the local content requirement policy, which creates employment opportunities and added value for local industry.”

Currently, only land rigs are built and operated, but there are plans to extend manufacturing capabilities to offshore rigs.

KS Drilling also operates six conventional land rigs on Chevron’s Duri field on Sumatra. Two of these are drilling, and four are conducting workovers.

Australia

“Australia’s kind of a feast or famine market,” Mr Payne said. “You don’t have a large number of smaller developments that keep the market ticking along inbetween the big ones. The reason is Australia is an export market, so it’s unviable to develop the small fields unless you can tie them back into the existing infrastructure and unless you have a market for your gas.”

The region is also threatened by an oversupply of natural gas, particularly from the US, but Mr Payne said that he believes the bigger threat is actually methane hydrates. “Japan is one of the biggest importers of LNG at the moment, and if it could have a very plentiful supply of gas (at home), then that could really change the game (for Australia) more than US shale,” he said.

PTTEP Australasia operates the Montara field offshore Australia and has plans to commercialize assets at its Cash Maple field, both in the Timor Sea. Montara already has three production wells.

“The Ensco 109 jackup rig mobilized to the Montara field in early September 2013 to drill a fourth production well. The fourth production well will enable output to reach a peak of 30,000 barrels per day of oil by the end of this year,” said Ed Lintott, drilling and well service manager for PTTEP Australasia. “Montara H-5 is a directional well that will land production casing nearly horizontally in the oil leg of the reservoir. Approximately 1,000 meters (3,280 ft) of horizontal production hole will be drilled to a total vertical depth of approximately 2,660 meters (8,727 ft) from the rig floor and a total measured depth of approximately 5,000 meters.” The well was expected to be completed in approximately 40 days.

The Cash Maple field is still in the preliminary concept selection stage. Confirmation of the development concept and final investment decision is planned for 2015. “Preliminary indications are that a combination of vertical and short to medium stepout wells will be used in at least two discrete phases, with approximately 10 wells in each phase,” Mr Lintott said. “Subject to confirmation of the concept selection, a conventionally moored mid-water depth semisubmersible drilling rig capable of running completions and subsea trees is anticipated.”

Japan

According to the Japanese government-industry consortium known as MH21, the Methane Hydrate R&D Program is an 18-year plan to achieve commercial production from methane hydrate deposits offshore Japan. It began in 2001 and is set to run through 2018. March 2013 saw the first successful production of methane gas from methane hydrates and demonstrated the viability of large-scale production. A further offshore test is scheduled between now and the end of 2015. Phase 3, to establish best practices for commercial production, will run between 2016 and 2018.

The first offshore production test produced approximately 120,000 cu meters of methane gas over six days from methane hydrate layers approximately 300 meters (984 ft) below the drilling surface in water depths of approximately 1,000 meters (3,281 ft). The CHIKYU drillship was used for the drilling operation; it is owned by the Japan Agency for Marine-Earth Science and Technology and managed by Japan Drilling Company (JDC). In addition to overseeing offshore drilling, JDC was involved in the design of the in-hole production system, a core technology to extract methane from methane-hydrate layers.

JDC president Yuichiro Ichikawa is optimistic about methane hydrate prospects: “Methane hydrate could become an alternate energy source to LNG when commercial production becomes reality. Japan is a mass consumer of LNG and thirsts after methane hydrate, which is said to be a next-generation energy in Japan.” The key factor to success will be how much Japan can reduce costs to make it economically and commercially viable, he said. “This viability will depend on the presence of abundant methane hydrate deposits under the seabed of Japanese waters. We still don’t know much about it, and further research studies are required for understanding the total amount of MH by the end of Phase 3.”

JDC also expects to be closely involved in the planning and operation of a possible methane hydrate rig. “A MODU to specialize in or fit to methane hydrate production would be deliberated, or hopefully be worked out concretely, in Phase 3,” Mr Ichikawa said.

JDC also owns 30% interest in Gulf Drilling International (GDI), a joint venture with Qatar Petroleum. Altogether, the group has a fleet of 11 jackups and two semisubmersibles. Of these rigs, four are currently operating in Southeast Asia.

The Hakuryu-10 jackup is contracted to Total in Indonesia, and the Hakuryu-11 jackup began drilling offshore Vung Tau, Vietnam, in July for Con Son JOC, which is a joint operating company among PetroVietnam Exploration Production Corp, Petronas Carigali Overseas, Pertamina and US-based Quad Energy. The Hakuryu-5 and Naga 1 semis are both drilling offshore Malaysia for Petronas/Petronas Carigali.

On the newbuilds front, JDC’s Hakuryu-12 400-ft jackup is under construction at PPL shipyard in Singapore, with an expected delivery of Q1 2015. GDI just had a 300-ft jackup delivered from Keppel in Q3 2013 to work in Qatar and has another 300-ft jackup on order with Keppel, with expected delivery in Q3 2014.

Mr Ichikawa noted that dayrates are running between US$150,000 and $200,000 for its high-spec jackups, trending upward along with increasing worldwide demand. Dayrates for standard jackups are stable between US $70,000 and $120,000, and semis that rate below 3,000 ft (914 meters) are averaging around US$250,000.

China

China continues to invest heavily to develop its domestic unconventional energy resources, including coalbed methane (CBM). Two main Chinese companies – China United Coalbed Methane and PetroChina – have been working alongside foreign companies under production-sharing contracts. The main geographical focus is the major coal-bearing Qinshui and Ordos Basins in midwest China, but there are also CBM resources in Sichuan and Xinjiang.

US-listed Far East Energy is the operator of three production-sharing contracts in Shanxi and Yunnan provinces, currently focusing on the Shouyang CBM project in Shanxi Province, approximately 233 miles (375 km) southwest of Beijing.

The Chinese government is supporting gas and CBM via higher prices and higher subsidies to encourage growth. Far East Energy is currently receiving a gas price of approximately US$6.50/mcf, including a subsidy given to CBM producers in China, for sales made to an offtaker within Shanxi Province. Far East Energy CEO Michael McElwrath said he expects gas prices there to grow even higher.

“Effective 10 July 2013, city gate gas prices rose by an average of 15% across the country, with analysts projecting that this will translate into an increase of approximately 25% at the wellhead. That would push the Far East Energy price above US$8/mcf, over double the US Henry Hub price of approximately $3.7/mmbtu.” City gate pricing is used in China as prices for each major city; it varies from city to city.

There is a question mark over how much CBM can be commercially produced in China. Even though most Chinese coals contain high levels of gas, most of the coals that have been exploited for CBM so far in China have been low permeability and, hence, relatively more expensive to produce.

Mr McElwrath explained, “I know of no world-class CBM projects which did not have high-permeability coals, as high perm means that the operator can drill relatively simple and inexpensive vertical and deviated wells and still produce high volumes, whereas significant volumes can be achieved in low-perm coals only with high cost, high-risk multilateral wells that are likely to collapse due to the inability to use liners.”

Far East Energy has 21 rigs in operation from five local drilling contractors. Equipment is a combination of conventional Chinese-manufactured mechanical land rigs and Western-manufactured, faster-moving truck-mounted hydraulic rigs, which can rig up and drill approximately 40% faster than conventional rigs, according to the company.

“In the past seven months alone we’ve drilled 65 wells. That’s two-thirds as many wells as the sum total of all the other wells drilled in our previous eight years combined. There were 25 wells spudded in June alone. That’s almost one a day, a 300-per-year pace,” Mr McElwrath said.

Drilling depths are typically relatively shallow for CBM projects, ranging from 600 to 1,300 meters (1,969 to 4,265 ft).