Geothermal energy holds great potential, but technical, regulatory challenges must be overcome

Optimizing development timelines through streamlined environmental review processes could help lower costs, increase available opportunities for drillers

By Stephen Whitfield, Associate Editor

Last year, the US Department of Energy (DOE) released a report estimating that geothermal electricity generation capacity has the potential to increase to more than 60 GW by 2050. That would be a nearly 2,600% increase over 2019 levels and would represent 8.5% of US energy generation.

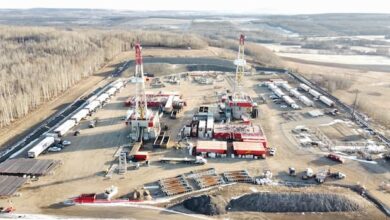

Clearly, geothermal energy has vast potential as a low-carbon solution, and it utilizes much of the same drilling infrastructure currently used in the oilfield.

However, to realize that potential, a significant amount of risk in geothermal development projects must be overcome, in both technical and non-technical aspects, and costs must be lowered. Only then will investments in geothermal projects expand sufficiently to create a robust supply chain, including drilling contractors and their rigs.

Panelists discussed these and other challenges at a session dedicated to geothermal energy at the virtually held 2020 IADC Advanced Rig Technology Conference on 1 September.

Geothermal Limitations

Because it does not consume fuel to generate power, geothermal power plants have low operational and maintenance costs. It is also not dependent on factors like rain, wind or sun exposure, and it can provide a constant source of energy.

Despite these advantages, geothermal production makes up only 0.4% of net electricity generation in the US, according to the US Energy Information Administration (EIA). Globally, the International Energy Agency estimates geothermal saw just a 3% increase from 2018 to 2019.

One reason for the low figures is the limited availability of suitable hydrothermal reserves. Another reason is the high capital costs and investment risk because of the long development timelines associated with geothermal wells, compared with other utility-scale power generation projects.

Further, geothermal power plants must be built near the reservoirs as the steam and hot water cannot be transported long distances, since the heat would be lost in the process. “You can’t put it in a truck,” said Geoffrey Garrison, VP and Senior Geochemist at AltaRock Energy.

All of these limitations have translated into a low number of geothermal wells drilled per year. In California, which has the world’s largest installed capacity of geothermal power generation, 860 geothermal wells were drilled in 2017, according to the DOE’s latest GeoVision study. By comparison, the state, which is hardly a hotbed for oil and gas drilling, had 892 oil and gas wells drilled the same year, while the Permian Basin saw 4,255 wells drilled.

Standard geothermal operations use spool wellhead systems instead of unitized wellheads, said Bill Rickard, President and Principal Drilling Engineer at the Geothermal Resource Group. This saves rig time, in part, because they do not require the removal of the BOP stack to complete the casing-hanger and seal-installation process.

However, “trying to get a drilling contractor to invest in this system, for an industry that’s a very small percentage of their market, just isn’t going to happen,” Mr Rickard said. “The return on investment just isn’t there for the drilling contractor.”

In order to create more drilling opportunities that will attract drilling contractors to geothermal, reducing the cost to entry is a must. Slim-hole drilling in the initial exploration phase is a potential way to minimize well development costs, since it requires less material to prepare a well and uses less manpower, said Doug Blankenship, Manager of Geothermal Research at Sandia National Laboratories.

Mr Blankenship also cited wireline coring as a valuable technology for early exploration: “In the prospecting of geothermal resources, particularly the hydrothermal resources, you’re limited to a very specific target location. So, improvements there are a big deal.”

To mitigate geographical limitations, AltaRock has developed an enhanced geothermal system that uses hot, dry basement rock to create artificial reservoirs. It uses hydraulic pressure to create a network of small, interconnected fractures in the rock, which then act as a radiator that transfers the heat in the rock to water circulating through the system. It is similar to traditional hydraulic fracturing, except that it does not require the use of chemically based frac fluids.

The system eliminates the need to drill near existing reservoirs by allowing reservoirs to be artificially created. This would create opportunities for geothermal development in previously unsuitable areas.

“We’re trying to sell the idea that, in order to really achieve economies of scale in geothermal, you need to go hotter and deeper and really achieve higher energy densities in the fluids that we extract from the ground,” Mr Garrison said. “If we can get those fluids out of the ground, all this expenditure that goes into exploration and thermal drilling effectively becomes much more attractive for investors.”

Geothermal resources at temperatures above 300°F at a depth of around 4 miles are accessible with existing drilling technology, according to the GeoVision study.

Regulatory Challenges

Beyond logistical challenges, optimizing the permitting process could also help to shorten the development timelines that hinder investment in geothermal. Currently, geothermal projects on federally managed land may be subject to up to six environmental reviews under the National Environmental Policy Act (NEPA), including:

- Separate NEPA reviews at the land-use planning and leasing phases before federal agencies consider lands for leasing;

- Reviews for exploration and resource confirmation;

- A review for field development; and

- An environmental impact statement for the power plant and transmission lines.

In addition, existing regulations from the US Bureau of Land Management (BLM) include a categorical exclusion specific to geothermal exploration, stipulating that exploration activities cannot cause ground disturbance (for instance, constructing access roads or well pads) or touch the geothermal resource. Ground disturbances require additional approvals from the BLM, which often are not granted without an additional NEPA review.

After adding these regulatory requirements to actual exploration activities like seismic surveys, exploration drilling, field development, and production and injection well drilling, a geothermal project’s development timeframe could last between seven to 10 years, according to the GeoVision study. The timeline may stretch even longer depending on the requirements associated with processing a lease nomination.

Typically, before a land management agency (either the BLM or a state agency) can lease federal or state lands, that agency must complete a pre-leasing analysis. This process has produced a so-called “lease sale queue,” which has historically taken as long as five years to clear.

Some developers have attempted to conduct NEPA reviews that evaluate multiple project phases in one step, but combined NEPA reviews increase upfront risks and costs for a developer. Combined NEPA reviews that are based on incomplete or inadequate resource information, usually gathered during exploration drilling, require the proposal and inclusion of a wide array of backup development locations in case a problem arises with the primary location.

Overcoming the complexity of these regulatory processes will certainly support increased geothermal development, the study noted. In particular, by placing the regulatory and permitting requirements for geothermal on a level similar to oil and gas drilling, permitting and regulatory process times could be significantly shortened.

If this happens, then geothermal electricity generation capacity could reach 13 GW by 2050, instead of the 6 GW that is currently projected in the study. If you add in technology improvements on top of that, then that capacity could be further increased to 60 GW by 2050.

“Getting a permit for oil and gas looks much different than it does for geothermal, and that’s just because of the way the regulations are written,” said Katherine Young, Laboratory Program Manager of I-Geoscience at the National Renewable Energy Laboratory. “If we simply reduce the project timeline to where a project takes four years instead of eight years, we could double deployment without any additional technology. That’s a really eye-opening analysis.” DC